2019 Tax Rates, Standard Deduction Amounts by IRS

By John Wolf

2019 Tax Rates, Standard Deduction Amounts by IRS

The U.S. Bureau of Labor Statistics Reported that the consumer price index (CPI) for August 2018 increased by 0.2 percent, July CPI increased too by 0.2.

The CPI represents the cost of good and services we need to live or the cost of living in simple words. There is a direct relationship between the CPI and the interest rate. When the cost of living goes up the interest on loans goes up too, Money can be taken as goods as well as represent the purchasing power. A low rate of inflation will keep the interests study.

The CPI influences the taxpayers because the Tax Code must make annual adjustments based on inflation for some items. Inflation means that there is more money in the public hands that can buy fewer goods because the price goes up.

The Internal Revenue Service (IRS) will figure cost-of-living adjustments for 2019 differently. The Tax Cuts And Jobs Act (CAJA) changed the way IRS will relate to the cost of living, it will not be a normal CPI but a chained CPI. A chained CPI will measure the public response to higher prices, not just the higher price itself. The chained CPI will have smaller adjustments.

IRS Releases 2019 Cost-of-Living Adjustments

Here are some samples of chained CPI.

Cost of living is expressed as Inflation when the price goes up and deflation when prices go down. Tax laws require adjustments from standard deduction amounts to federal gift tax exemptions.

We can find some help in the released Bloomberg Tax predicted rates for 2019. You can read the quotes below.

“While the IRS won’t announce actual inflation adjustments for next year for some time, our projections help taxpayers and tax planners get a jumpstart on the 2019 tax planning season by allowing them to more accurately estimate their tax liabilities for the upcoming year,” said George Farrah, Bloomberg Tax Editorial Director. “This process is especially important for 2019 because most of the changes under the 2017 tax act will be in effect. Taxpayers and their advisors should pay close attention to the impact of inflation adjustments determined using the chained CPI index on income tax bracket thresholds and other tax amounts.”

For the tax year 2019 we predicted the following numbers.

Tax Brackets

A higher CPI will push the brackets up and so the standard deduction and exemption amounts, the tax will decrease.

Here are how the rates we expect will look like:

| Single | |

| Taxable Income | Tax Rate |

| $0 – $9,525 | 10% of taxable income |

| $9,526 – $38,700 | $952.50 plus 12% of the amount over $9,525 |

| $38,701 – $82,500 | $4,453.50 plus 22% of the amount over $38,700 |

| $82,501 – $157,500 | $14,089.50 plus 24% of the amount over $82,500 |

| $157,501 – $200,000 | $32,089.50 plus 32% of the amount over $157,500 |

| $200,001 – $500,000 | $45,689.50 plus 35% of the amount over $200,000 |

| $500,001 or more | $150,689.50 plus 37% of the amount over $500,000 |

| Married Filing Jointly or Qualifying Widow(er) | |

| Taxable Income | Tax Rate |

| $0 – $19,050 | 10% of taxable income |

| $19,051 – $77,400 | $1,905 plus 12% of the amount over $19,050 |

| $77,401 – $165,000 | $8,907 plus 22% of the amount over $77,400 |

| $165,001 – $315,000 | $28,179 plus 24% of the amount over $165,000 |

| $315,001 – $400,000 | $64,179 plus 32% of the amount over $315,000 |

| $400,001 – $600,000 | $91,379 plus 35% of the amount over $400,000 |

| $600,001 or more | $161,379 plus 37% of the amount over $600,000 |

| Married Filing Separately | |

| Taxable Income | Tax Rate |

| $0 – $9,525 | 10% of taxable income |

| $9,526 – $38,700 | $952.50 plus 12% of the amount over $9,525 |

| $38,701 – $82,500 | $4,453.50 plus 22% of the amount over $38,700 |

| $82,501 – $157,500 | $14,089.50 plus 24% of the amount over $82,500 |

| $157,501 – $200,000 | $32,089.50 plus 32% of the amount over $157,500 |

| $200,001 – $300,000 | $45,689.50 plus 35% of the amount over $200,000 |

| $300,001 or more | $80,689.50 plus 37% of the amount over $300,000 |

| Head of Household | |

| Taxable Income | Tax Rate |

| $0 – $13,600 | 10% of taxable income |

| $13,601 – $51,800 | $1,360 plus 12% of the amount over $13,600 |

| $51,801 – $82,500 | $5,944 plus 22% of the amount over $51,800 |

| $82,501 – $157,500 | $12,698 plus 24% of the amount over $82,500 |

| $157,501 – $200,000 | $30,698 plus 32% of the amount over $157,500 |

| $200,001 – $500,000 | $44,298 plus 35% of the amount over $200,000 |

| $500,001 or more | $149,298 plus 37% of the amount over $500,000 |

| The tax rate schedule for estates and trusts in 2019 is as follows: | |

| If taxable income is: | The tax is: |

| Less than $2,600 | 10% of taxable income |

| Over $2,600 but not over $9,300 | $260 plus 24% of the excess over $2,600 |

| Over $9,300 but not over $12,750 | $1,868 plus 35% of the excess over $9,300 |

| Over $12,750 | $3,075.50 plus 37% of the excess over $12,750 |

Capital Gains

For 2019 there are no changes in Capital gains. The breakpoint for the rates will have changes.

Bloomberg Tax make the anticipation as bellow,

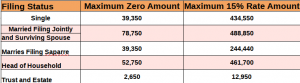

Maximum zero rate amounts and maximum 15% rate amounts will break down as follows:

Personal Exemption Amounts

One of the changes made by the TCJA is that there are no more personal exemption amounts for 2019.

The personal exemptions used to decrease your taxable income before your tax was determined. You could take one exception for yourself. If you filed as a joint, you could have one more for your spouse and one for each of the dependent. This is no longer the case.

The exemption amount for a qualified relative is deemed to be $4,200 according to Bloomberg or $4,150 that is expected from the IRS to publish.

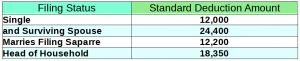

Standard Deduction

The standard deduction doubled at 2018 tax-year.

The inflation will be slightly higher.

Here are the projected standard deduction amounts for 2019:

The prediction for 2019 is that the standard deduction for an individual that can claim as a dependent by a fellow taxpayer will not exceed the:

- $1,100, or

- The sum of $350 added to the individual’s earned income.

- The additional standard deduction amount for an aged or blind will be $1,300

- The additional usual deduction amount will increase to $1,650 if the individual is unmarried and not a surviving spouse.

- High-income taxpayers that choose to itemize their deduction, as a result of the TCJA, there are no Pease limitations in

- 2019.

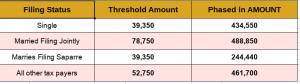

Section 199A deduction (also called the pass-through withholding)The TCJA code gave sole owners and proprietors of pass-through businesses to be eligible for a deduction of up to 20% to bring the tax rate lower the qualified business income. The deduction has to adjust to some threshold and phased-in amounts. For 2019, we predict those amounts will look like this:

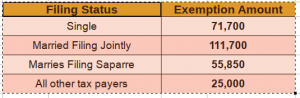

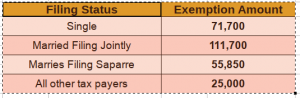

Alternative Minimum Tax (AMT)

The AMT exemption rate fluctuates with inflation rates

Bloomberg Tax anticipates that the exemption amounts will look like this in 2019:

Retirement Savings Accounts

Bloomberg Tax projects For 2019, the maximum contribution limit for traditional and Roth IRAs will rich up to $6,000 for individuals under age 50 with catch-up contribution totals hitting $7,000 for individuals age 50 and above.

Federal Estate Tax Exclusion

The federal estate tax exclusion for decedents dying in 2018 was $11.2 million. BNA predict that this amount will increase up to $11.4 million – per person – Es a result of the TCJA.

Gift Tax Exclusion

The annual exclusion for federal gift tax purposes will stay at $15,000 in 2019 giving you the option to give anyone you want a gift of up to $15,000 with no federal taxation. Splitting with your wife will make you the total of $30,000 tax-free.

We reviewed enough for the planning of 2019 tax year. Remember to check the IRS most recent updating.