Presented by Paystrubmakr.com  By John Wolf and Tom Cullen CPA

By John Wolf and Tom Cullen CPA

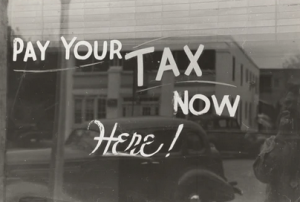

3 Ways to Calculate Your Tax Refund for 2023 Using Your Pay Stub

If you were entitled to a huge tax refund last year, or maybe you are entitled to a big fat refund check this year, then it’s time to start estimating your refund amount ahead of tax season filing time. We are all aware that there will be no guarantee until the money is actually in the bank, but you can get a clear idea of your refund amount using your pay stubs at least by December and probably a lot sooner than that, assuming you have a regular gig with consistent work hours (not always safe to assume these days!).

Below is a list of the ways in which a person can calculate their refund just by using online resources, paycheck stubs, and IRS forms.

- Online calculator tools

If you want to do the estimation of your refund before you receive your W2, online calculator tools can generate this information for you in a few minutes. To get started, you simply need to fill in your demographic info – like your age, the state you live in, your filing status, whether you’re married, whether you’re claiming dependents and your number of exemptions.

After this step, you can use your last paycheck stub to enter your taxable wages for the year. You can calculate your year-end taxable wages by adding your year-to-date taxable wages to any leftover taxable wages not included in the pay stub you are using. The same rule applies when it comes to social security and federal withholding. Use the year-to-date amount including any additional amount you paid throughout the year to determine the appropriate number to enter into the online calculator. 2020-2021 federal income tax brackets

Next, you choose the standard deduction and analyze anything that you plan to itemize as part of your deductions, which can certainly be beneficial depending on your individual situation. Then, the online calculator will ask you about tuition credits and other applicable tax benefits. If nothing has changed, you can apply the same amounts from your last year’s tax return to those boxes, or you can also leave them out and determine the accurate amounts come tax time.

Tax 2020

Tax 2020

- A free-software program

By using a free online program like FreeTaxUSA or TaxACT (which is free depending on your filing situation), you can estimate your refund. You just have a create a new account, and it will take only a few minutes to enter all your information. These programs will also calculate your return automatically. The main difference between these programs and calculator tools is that free filing programs are much more detailed and in-depth but often have add-on costs for many things you will want to do. With any of these online services, you will have to answer a series of questions and then can estimate your wages and tax information.

- The traditional way

Perhaps the most daunting and time-consuming way to estimate the amount of your tax refund is by using IRS form 1040. Just trying to read that document is scary (IMO). If the tax you should pay is higher than what you did pay, then you receive a refund. Online software and programs use the same formula, and the only difference is with the IRS form 1040, you are completing the form yourself, by hand, without anyone making sure you do it right (scary).

If you have no idea how to fill out a pay stub and want to learn more, then visit http://paystubmakr.com/, where you can also generate your own professional quality paystub, including accurate State and Federal income tax deductions.

paystumbmakr.com team thanks you for a visit and reading this blog Pays tub online About pay stubs

Learn how to create your pay stub

paystubmakr.com

Disclaimer: John Wolf and paystubmakr.com are making a total effort to offer accurate, competent, ethical HR management, employer, and workplace advice. We do not use the words of an attorney, and the content on the site is not given as legal advice. The website has readers from all US states, which all have different laws on these topics. The reader should look for legal advice before taking any action. The information presented on this website is offered as a general guide only.