Presented by Paystrubmakr.com ![]() By John Wolf and Tom Collen CPA

By John Wolf and Tom Collen CPA

Since 2012, the size of the regular income tax rate brackets for a married couple filing a joint return are generally twice the regular income tax rate brackets for an unmarried individual filing a single return.

Note: The marriage penalty relief for the standard Deduction, the various brackets, and the EITC was made permanent for taxable years beginning later than December 31, 2012. Marriage penalty

As a result, for 2018, the size of the various tax brackets for joint filers and qualified surviving spouses remains at 200% of the different tax brackets for individual filers (§1(i)(1)). In fact, for 2018, the married filing jointly income thresholds are exactly double the single thresholds for all but the two highest tax brackets. In other words, the marriage penalty has been effectively eliminated for everyone except married couples earning more than $400,000.

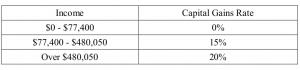

Capital Gain & Qualified Dividend Rate

Despite the TCJA, the capital gains tax system retains the prior law maximum rates on net capital gain and qualified dividends. For 2018, the 15% capital gain tax rate breakpoint is $77,400 ($38,700, for single filers) for joint returns and surviving spouses. The 20% capital gain tax rate a breakpoint is $480,050 ($424,950, for single filers) for joint returns and surviving spouses. Below is a chart of capital gain rates (MFJ) based on Income for 2018:

Income Capital Gains Rate

Note: As under prior law, short-term capital gains are still taxed as ordinary income and unrecaptured §1250 gain generally is taxed at a maximum rate of

25%, and 28% rate gain is taxed at a maximum rate of 28%. Same-Sex Marriage

On June 26, 2013, the U.S. Supreme Court held unconstitutional Section 3 of

the Defense of Marriage Act (DOMA) in a 5 to 4 decision (E.S. Windsor,

SCt., 2013-2 USTC ¶50,400). Thereafter, the IRS ruled (R.R. 2013-17) it will treat all legally (based on place of celebration) married same-sex couples as married for all federal tax purposes, including income and gift and estate taxes, regardless of whether the couples’ state of residence recognizes same-sex marriage.

Note: The IRS also provided that individuals in a same-sex marriage may file original or amended returns for still open tax years and choose to be treated as married. However, the IRS stated that it does not treat registered domestic partners, individuals in a civil union, or similar relationships as married or federal tax purposes. On June 26, 2015, in Obergefell v. Hodges, 576 U.S. ___ (2015), the Supreme

Court held that states must issue licenses for same-sex marriages and must recognize same-sex marriages lawfully performed in another state. Thus, same-sex marriages are recognized, for tax purposes, regardless of where the couple resides. The ruling avoids a mismatch between filing status for federal and state purposes and now treats such couples as married for both purposes.

Innocent Spouse Relief – §6015(f)

In 2002, the IRS announced regulations setting forth a two-year deadline for requesting innocent spouse relief under §6015(f). However, there were two significant developments in 2013. First, in August 2013, the Service issued regulations (NPRM REG132251-11) that would remove the two-year dead-

line. Second, in September 2013, Rev. Proc. 2013-34 (modifying and superseding Rev. Proc. 2003-61) updated the IRS’s equitable innocent spouse relief procedures.

Standard Deduction – §63

Nearly two out of three taxpayers choose to take the standard deduction rather than itemizing deductions such as mortgage interest and charitable contributions. The basic standard deduction varies depending upon a taxpayer’s filing status – married filing separately, single, head of household, married filing jointly and surviving spouse. The standard deductions for 2018 and 2017 are:

Note that the standard deduction amount for married filing jointly is twice the amount of those taxpayers filing as single or married filing separately. This marriage penalty relief in the standard deduction amounts is now permanent for taxable years beginning after December 31, 2012.

The additional standard deduction for the elderly and blind is increased as follows for 2018:

(1) Unmarried taxpayer: an additional $1,600 – up from $1,550 in 2017

($3,200 for a taxpayer who is both elderly and blind); and (2) Married taxpayer: an additional $1,300 – up from $1,250 in 2017 ($2,600

for a taxpayer who is both elderly and blind) (§63(f)).

Dependent Limit – §63(c)(5)

In 2018, if an individual may be claimed as a dependent on another taxpayer’s return then the standard Deduction is limited to the lesser of:

(1) The dependent’s earned Income up to the basic standard Deduction

($12,000 in 2018), or

(2) The greater of:

(a) $1,050 (same as in 2017), or

(b) The dependent’s earned income plus $350 (same as in 2017)

(§63(c)(5)).

Personal Exemptions & Phaseout (Suspended) – §151

Prior to 2018, most taxpayers could take personal exemptions for themselves and an additional exemption for each eligible dependent ($4,050 in 2017). Thus, personal exemptions generally were allowed for the taxpayer, his or her spouse, and any dependents. An individual who qualified as someone else’s dependent could not claim a personal exemption.

In the past, personal and dependency exemptions were phased out for higher-income taxpayers. However, this phaseout was gradually eliminated from 2006 to

2010 is reduced by one-third in 2006 and 2007, two-thirds in 2008 and 2009,

and in 2010, completely eliminated. Nevertheless, the phase-out was reinstated in 2013.

Thus, for 2017, the reinstated phaseout of personal exemptions had the same limitations as those imposed on itemized deductions under §68 and begins at AGI levels of:

Despite tax overhaul, the marriage penalty still hits many couples

All exemption amounts claimed on a return were reduced by 2% (4% if married

filing separately) for each $2,500 (or fraction thereof) of AGI in excess of the above threshold amount. As a result, exemption deductions were completely

eliminated when AGI exceeds the AGI threshold amount by more than $122,500

($61,250 for married individuals filing separately).

Note: It takes 50 two-percent reductions to achieve a 100-percent reduction.

Since 49 two-percent reductions would result from an excess of $122,500 (49

5x $2,500 = $122,500), any excess above $122,500 would be a fraction of a $2,500 amount and create the 50th two-percent reduction.

As a result, the personal and dependency exemptions were completely phased out in 2017 at AGI levels of:

However, from 2018 through 2025, the TCJA now suspends (eliminates) person-

al exemptions (and the personal exemption phase-out).

Limitation on Itemized Deductions – §68

In lieu of taking the applicable standard deductions, an individual may elect to itemize deductions. However, prior to 2018, total itemized deductions otherwise allowable were reduced under §68 by 3% of a taxpayer’s AGI in excess of specified threshold amounts. This overall limitation applied to itemized deductions after all other floors were applied. After the application of the 3% floor, the “net itemized deductions” remained. The “minimum” amount of “net itemized deductions” was the medical expense,

casualty and theft loss, and investment interest deductions plus 20% of the other itemized deductions allowable.

Note: Starting in 2006, this overall limitation on itemized deductions was gradually repealed and was fully removed by the end of 2012. However, in

2013, the §68 limitation was reinstated.

For 2017, the total amount of itemized deductions allowed is reduced by $0.03 for each dollar of AGI in excess of $261,500 (single) (up from $259,400 in 2016),

$287,650 (head-of-household) (up from $285,350 in 2016), $313,800 (married filing jointly & surviving spouse) (up from $311,300 in 2016) and $156,900 (married filing separately) (up from $155,650 in 2016). These threshold amounts are indexed for inflation (R.P 2016-55).

However, for taxable years beginning after 2017 and before 2026, the TCJA suspends (eliminates) the overall limitation on itemized deductions.

Itemized Deductions Subject to 2% Floor Fully Denied

Itemized deductions for certain miscellaneous expenses cannot be deduced unless, in aggregate, they exceed 2% of the taxpayer’s adjusted gross Income (§§62, 67 & 212). The following deductions have been subject to this aggregate 2% floor:

6(1) expenses for the production or collection of Income (§212), such as:

(a) appraisal fees for a casualty loss or charitable contribution;

(b) casualty and theft losses from property used in performing services as an employee;

(c) clerical help and office rent in caring for investments;

(d) depreciation on home computers used for investments;

(e) excess deductions (including administrative expenses) allowed a bene-

fiduciary upon the termination of an estate or trust;

(f) fees to collect interest and dividends;

(g) hobby expenses, but generally not more than hobby income;

(h) indirect miscellaneous deductions from pass-through entities;

(i) investment fees and expenses;

(j) loss on deposits in an insolvent or bankrupt financial institution;

(k) loss on traditional IRAs or Roth IRAs, when all amounts have been distributed;

(l) repayments of Income;

(m) safe deposit box rental fees, except for storing jewelry and other personal effects;

(n) service charges on dividend reinvestment plans; and (o) trustee’s fees for an IRA, if separately billed and paid, Marriage penalty Wikipedia

(2) tax preparation expenses (§212),

(3) unreimbursed expenses attributable to the trade or business of being an employee (§§62 & 67), such as:

(a) a business bad debt of an employee;

(b) business liability insurance premiums;

(c) damages paid to a former employer for breach of an employment contract;

(d) depreciation on a computer a taxpayer’s employer requires him to use

in his work;

(f) dues to professional societies;

(g) educator expenses (except for special $250 above the line deduction);

(h) home office or part of a taxpayer’s home used regularly and exclusive-

ly in the taxpayer’s work;

(i) job search expenses in the taxpayer’s present occupation; (j) laboratory breakage fees;

7(k) legal fees related to the taxpayer’s job;

(l) licenses and regulatory fees;

(m) malpractice insurance premiums;

(n) medical examinations required by an employer;

(o) occupational taxes;

(p) passport fees for a business trip;

(q) repayment of an income aid payment received under an employer’s

plan;

(r) research expenses of a college professor;

(s) rural mail carriers’ vehicle expenses;

(t) subscriptions to professional journals and trade magazines related to

the taxpayer’s work;

(u) tools and supplies used in the taxpayer’s work;

(v) purchase of travel, transportation, meals, entertainment, gifts, and local lodging related to the taxpayer’s work;

(w) union dues and expenses;

(x) work clothes and uniforms if required and not suitable for everyday

use; and

(y) work-related education, and

(4) other miscellaneous itemized deductions, such as:

(a) repayments of Income received under a claim of right (only subject to the 2% floor if less than $3,000);

(b) repayments of Social Security benefits; and

(c) the share of deductible investment expenses from pass-through entities.

From 2018 through 2025, all miscellaneous itemized deductions that are subject to the 2% floor are suspended. Thus, taxpayers may not claim the above-listed items as itemized deductions for the taxable years to which the suspension applies. An individual also remains unable to claim such deductions in calculating his or her AMT liability.

Unearned Income of Children (“Kiddie Tax”) – §1(g)

The rules regarding the age of a child whose investment income could be taxed at the parent’s tax rate applied to a child who:

(1) had not attained age 18 before the close of the taxable year;

(2) had attained age 18 (but not 19) before the close of the taxable year and did not have earned income that was more than half of the child’s support, or

8(3) was a full-time student over age 18 and under age 24 at the end of the year and did not have earned income that was more than half of the child’s

support.

Note: A student is a child who during any part of 5 calendar months of the year was enrolled as a full-time student at a school, or took a full-time, on-

the farm training course is given by a school or a state, county, or local government agency. A school includes a technical, trade, or mechanical school. It does not include an on-the-job training course, correspondence school, or school offering courses only through the Internet. Form 8615 is used to figure the “kiddie” tax.

For 2017, the standard deduction for a dependent could not exceed the greater of $1,050, or the sum of $350 and the dependent’s earned Income (§63(c)(5)(A)).

This impacted the application of the “kiddie” tax (§1(g)). The application threshold for the “kiddie” tax was twice the $1,050 limitation. Thus, the amount of taxable investment income a child could have without it being subject to the parent’s rate in 2017 was $2,100. Form 8615 was used to figure the “kiddie” tax.

For taxable years beginning after 2017 and before 2026, the TCJA simplifies the “kiddie tax” by effectively applying ordinary and capital gains rates applicable to trusts and estates to the net unearned income of a child. Thus, as under present law, taxable Income attributable to earned income is taxed according to an unmarried taxpayers’ brackets and rates. Taxable Income is attributable to net un-

earned income is taxed according to the brackets applicable to trusts and estates,

with respect to both ordinary Income and Income taxed at preferential rates.

Note: The child’s tax is unaffected by the tax situation of the child’s parent or the unearned income of any siblings.

AMT – §55

An alternative minimum tax is a parallel income tax system, which does not allow certain regular tax system deductions, and is imposed on an individual, estate, or trust in an amount by which the tentative minimum tax exceeds the regular income tax for the taxable year.

The tentative minimum tax is the sum of:

(1) 26% of so much of the taxable excess as does not exceed $95,550 for 2018

(up from $93,900 in 2017) in the case of a married individual filing a separate return and $191,100 in 2018 (up from $187,800 in 2017) for all other returns,

and

(2) 28% of the remaining taxable excess (R.P. 2018-18).

Note: Formerly, a single rate of 20% applied to corporations. However, for 2018 and later, the AMT is repealed for corporations.

The taxable excess is so much of the alternative minimum taxable income (“AMTI”) as exceeds the exemption amount.

Exemption Amounts & Permanent “Patch” – §55(d)(1)

Originally enacted to ensure that wealthy taxpayers did not escape paying any taxes, increasingly the AMT annually threatened middle-income taxpayers because it lacked inflation adjustment. Congress reacted by sporadically enacting “patches” to the AMT exemption amounts to protect such taxpayers.

In 2012, Congress once again inflation-adjusted the AMT exemption amounts, but with a major difference the “patch” is permanent and the

AMT exemption amounts are indexed for inflation after 2012. Annual “patches” are no longer be needed.

For 2018, exemption amounts (now inflation adjusted & recently increased by the TCJA) are:

(1) $109,400 (up from $84,500 in 2017) in the case of married individuals filing a joint return and surviving spouses;

(2) $70,300 (up from $54,300 in 2017) in the case of single or head of households;

(3) $54,700 (up from $42,250 in 2017) in the case of married filing separately (i.e., 50% of married filing jointly), and (4) $24,600 (up from $24,100 in 2017), in the case of an estate or trust.

(R.P. 2017-58). AMT Exemption Phaseout – §55(d) & §59(j)

The 2018 exemption amounts are phased out by an amount equal to 25% of the amount by which AMTI exceeds:

(1) $1 million (up from $160,900 in 2017) in the case of married individuals filing a joint return and surviving spouses,

(2) $500,000 (up from $120,700 in 2017)in the case of single or head of

households,

(3) $500,000 (up from $80,450 in 2017) in the case of married filing separately, and

(4) $82,050 (up from $80,450 in 2017), if an estate or trust (R.P. 2017-58).

Note: The TCJA did not affect the AMT exemption amount and phaseout threshold for an estate or trust.

Thus, in 2018, the exemption amount is completely phased out if AMT taxable income exceeds:

(1) $1,437,600 (up from $498,900 in 2017), if married filing a joint return or a qualifying widow or widower,

(2) $781,200 (up from $337,900 in 2017), if single or head of household,

(3) $718,800 (up from $249,450 in 2017), if married filing a separate return, and

10(4) $180,450, if an estate or trust.

AMT & Personal Credits

Under prior law, certain nonrefundable personal credits (including a dependent care credit and the elderly and disabled credits) were not allowed directly against the AMT but only permitted to the extent that regular income tax liability exceeded the tentative minimum tax. However,

Congress typically enacted temporary provisions permitting such credits to offset the entire regular and AMT liability. Since 2013, this offset is permanent.

New Inflation Adjustment

Many parameters of the tax system are adjusted for inflation to protect taxpayers from the effects of rising prices. Most of the adjustments are based on annual

changes in the level of the Consumer Price Index for All Urban Consumers

(“CPI-U”). The CPI-U is an index that measures prices paid by typical urban consumers on a broad range of products and is developed and published by the

Department of Labor. For 2018 and later, The Chained Consumer Price Index for All Urban Consumers (“C-CPI-U”) must be used to adjust tax parameters currently indexed by the CPI-U. The C-CPI-U differs from the CPI-U in accounting for the ability of individuals to alter their consumption patterns in response to relative price changes.

Wage Base for Social Security & Medicare Taxes

The social security contribution and benefit base for remuneration paid and self-employment income earned in tax years beginning in 2018 are $128,700 (up from $127,200 in 2017). There is no limit on the number of wages subject to the Medicare tax.

Note: For 2017 & 2016, the domestic employee coverage threshold, as adjusted for inflation, is 2,000. This reflects an increase from $1,900 for 2014 &

2015. Earnings below the domestic employee coverage threshold are not taxable under Social Security (§3121).

Earned Income Tax Credit – §32

An earned income tax credit is available to low-income workers who satisfy certain requirements. One in six taxpayers claims the EITC, which, unlike most tax breaks, is refundable, meaning that individuals can get it even if they owe no tax and even if no tax is withheld from their paychecks. However, the amount of the EITC varies depending upon the taxpayer’s earned income and whether the taxpayer has one, two, more than two, or no qualifying children.

11The EITC generally equals a specified percentage of earned Income up to a maximum dollar amount. The maximum amount applies over a certain income range and then diminishes to zero over a specified phaseout range.

For taxpayers with earned Income (or adjusted gross income (“AGI”), if greater) in excess of the beginning of the phaseout range, the maximum EITC amount is reduced by the phaseout rate multiplied by the amount of earned income (or AGI, if higher) in excess of the beginning of the phaseout range. For taxpayers

with earned Income (or AGI, if greater) in excess of the end of the phaseout

range, no credit is allowed.

A temporary provision allowed taxpayers with three or more qualifying children to claim a credit of 45% for taxable years 2009 through 2017. The phase-out thresholds for married couples were also temporarily raised and indexed. In 2015, these temporary provisions were made permanent. As a result, the earned income base amounts, credit percentages, and phase-out information in 2018 for married filing jointly are as follows:

The EITC is a refundable credit, thus if the amount of the credit exceeds the taxpayer’s Federal income tax liability, the excess is payable to the taxpayer as a

direct transfer payment.

Disqualified Income – §32(i)

An individual is not eligible for the EITC if the aggregate amount of disqualified income of the taxpayer for the taxable year exceeds an indexed threshold. The amount of disqualified income (i.e., investment income) a taxpayer can have before losing the entire earned income tax credit is $3,500 for 2018 (up) from $3,450 in 2017).

Means-Tested Programs

The current tax law provides that the refundable components of the EITC and the Child Tax Credit (§24) do not make households ineligible for means-

teste d benefit programs and includes provisions stating that these tax credits do not count as income in determining eligibility (and benefit levels) in

means-tested benefit programs, and also do not count as assets for specified periods.

paystumbmakr.com team thanks you for a visit and reading this blog Pays tub online About pay stubs

Learn how to create your pay stub

paystubmakr.com

Disclaimer: John Wolf and paystubmakr.com are making a total effort to offer accurate, competent, ethical HR management, employer, and workplace advice. We do not use the words of an attorney, and the content on the site is not given as legal advice. The website has readers from all US states, which all have different laws on these topics. The reader should look for legal advice before taking any action. The information presented on this website is offered as a general guide only