PAYSTUB MAKER team hope that you enjoy reading more about S Corporation

words of the day:

Pay stubs are must-haves in business because they maintain the payroll transparency among the employers and employees. About paystubs: What kind of records should I keep?

Paystub maker is your place for the best template

Paystub maker is your place for the best template

Ancient paycheck

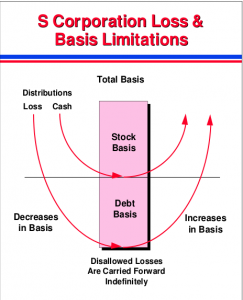

The amount of losses and deductions a shareholder can take is limited to the adjusted basis of:

(i) The shareholder’s stock, plus

(ii) Any loans the shareholder makes to the corporation.

A shareholder must adjust the basis of their stock in an S corporation and the basis of the debts the corporation owes the shareholder.

Calculation of Shareholder’s Stock and Debt Basis in S Corporation

La Yupana, Incas calculator

Adjustments to Basis

The shareholder increases the basis of their stock by the amount of corporate income taxed to the shareholder (§1367(a)(1)). The shareholder decreases the basis of their stock (but not below zero) by nontaxable distributions and by items of loss and deductions allocated to the shareholder (§1367(a)(2)).

If the items of loss and deduction reduce the basis of stock to zero, the shareholder can continue to deduct these items and reduce the basis of any debts owed by the corporation to the shareholder. If the shareholder does so, and later increases their basis because income items are allocated to them, the basis of the debt will be increased back to its original level (§1367(b)(2)).

Paystub Template and Generator

Limitation on Loss Deductions

If losses and deductions allocated to shareholder reduced to zero the basis of both stock and debt, the shareholder cannot deduct any further losses. However, such disallowed losses can be deducted in a later year if the basis of the stock or debt rises above zero (§1366(d)).

Mayas languge

S Corporation Loss Limitation Rules

Basis Limit

The amount of losses and deductions a shareholder can take is limited to

the adjusted basis of:

(1) The shareholder’s stock, plus

(2) Any loans the shareholder makes to the corporation.

To be able to arrive at the adjusted basis of a shareholder’s stock or loans, the shareholder’s basis must first be determined. If the stock was purchased, the basis is usually its cost. If money was loaned to the S corporation, the basis is usually the amount of the loan. If a shareholder received stock in the S corporation in exchange for property, his or her basis in the stock is the same as his or her basis in the property transferred.

Todays paying means

Adjustments to Stock Basis

During the time the corporation is an S corporation, each shareholder will increase or decrease the basis of his or her stock, but not below zero.

Paystub Generator at your service

Paystub Generator at your service

Adjustments to Stock Basis – IRS

Increases

Each shareholder’s pro rata stock of the following items increases the basis of the stock:

(1) All income items of the S corporation, including tax-exempt income that is separately stated and passed through to the shareholder,

(2) Any non-separately stated income of the S corporation, and

(3) The quantity of the deductions for depletion that is more than the basis of the property being depleted. If an amount described in (1) or (2), above, is required to be included in income, a shareholder may increase the basis of the stock only by the amount included as gross income on individuals income tax return. This amount is increased or decreased by any adjustments in a redetermination of the shareholder’s tax liability.

Paystub Maker team thanks you for reading its Blog

Next Blog will tell you more about S Corporation.