Child adoption is a costly process According to AdoptTogether, the average cost of adopting a child in the United States ranges from $5,000 to $ 40,000. For a local child. The adoption of an alien child will go up to $50,000. The total new adoption per year reaches about 135,000 children.

While intercountry adoption may be the most visible category, the majority of American adoptions actually involve children adopted out of foster care. About 135,000 children are adopted in the United States each year. Of non-stepparent adoptions, about 59 percent are from the child welfare (or foster) system, 26 percent are from other countries, and 15 percent are voluntarily relinquished, American babies.

Despite the high cost, some families open their homes and their life for those 135,000 children that need a worm and embracing shelter. The U.S. government thinks that those caring families deserve to be commanded and considered in their taxpaying like those who got their own born children and more.

It was in the late 90s when the federal government intentioned to relive the cost of adoption and encourage more families to adopt children. There is no difference if children are US-born or foreigners. The government created the adoption credit. In this article, we will review all that you need to enjoy the adoption credit.

IRS Words On Tax Benefits For Adoption

Tax benefits for adoption include both a tax credit for qualified adoption expenses paid to adopt an eligible child and an exclusion from income for employer-provided adoption assistance. The credit is nonrefundable, which means it’s limited to your tax liability for the year. However, any credit in excess of your tax liability may be carried forward for up to five years. The maximum amount (dollar limit) for 2019 is $14,080 per child.

Read On Adoption Credit?

The tax credit is the amount of your net profit before tax that you can subtract from the total government amount of tax. There are a few credits with the amounts related to the nature of the credit. The adoption tax credit is a federal tax credit that you can claim on the part of your expenses during the process of adopting a child.

The total amount of adoption credit allowed in 2019 the total is $14,080 per child. You can carry the credit for a maximum of five years if you have tax liabilities. The adoption credit is not refundable. You could benefit from it only if you have federal income tax liabilities.

IRS update

Adoption Credit Eligibility

When can you qualify for an adoption tax credit?

- An adoption tax credit can be considered if you incurred personal expenses while making an effort to adopt a child.

- The child must be below 18 years old.

- Physically or mentally incapable of self-care.

- It can be of any nationality.

All the necessary and reasonable expenses that you incurred while you are going on the process of adoption are applicable when they are proven.

You may claim for any adopting charge, attorney fees, travel, and lodging costs, or any other expenses related to the process.

You can not claim for:

- The cost of adopting a stepchild.

- Unlawful payments.

- Expenses paid by the money you got from the state, federal government or the state

- Payments that you had reimbursed by your employer or other parties for adoption.

How Your Income Affects the Adoption Credit Benefit?

Your general status as a tax-payer influence the adoption tax credit, it depends on how much are your earnings. You can save taxpaying on your income but not get a refund on this adopting expenses. You will start to feel the influence of this credit if your income is reaching the Modified Adjusted Gross Income (MAGI)of between $211,160 and $251,160. Only if you are on this bracket, you can claim only partial credit.

Families that are below the MAGI below $211,160 can claim the full amount of this credit. According to a 2017 change, if your modified adjusted gross income is above $251,160, you cannot claim for the adoption tax credit.

These values are fluctuating every year. It is according to the changes that the IRS makes on the tax system, adjusting the tax and the cost of living.

What happens When Adopting A Child With Special Needs

Things change when it is adopting a child with special needs. If you are adopting a child with special needs, you are entitled to claim the total amount of the tax credit.

In this case, even if the total amount of the tax credit is higher than the expenses or even no cost were occurred, you still entitled to enjoy the full benefits of this credit.

A “special needed child” has to be a US citizen or a legal resident of the US.

The welfare agency must decide for a child to be a special needs child. It must rule that the child should not go back to his or her previous home.

The state must declare that the adopting family requires assistance on the adoption. Some cases of mental or physical disabilities do not qualify as special needs. The same with children adopted from foster home care is considered as special care cases. In reality, there are only 10% of the children were adopted from the care system that needs the help of adoption assistance programs. To qualified for adoption credit, sècial needs adoption has to be beneficiary of adoption subsidy as this provision is aimed to encourage foster parents to adopt needed children and is granted regardless of your status as a taxpayer Special Needs Child.

A special needs child is a youth who has been determined to require special attention and specific necessities that other children do not. The state may declare this status for the purpose of offering benefits and assistance for the child’s well-being and growth. Special needs can also be a legal designation, particularly in the adoption and foster care community, wherein the child and guardian receive support to help them both lead productive lives.

If Adoption Fails, what happens?

Child adoption is not always successful, and there are many reasons for failing and looking again and again for a child and ens it successfully. If you failed in adoption and American child, you still could claim the tax credit for adoption. If the adoption is of a foreign child, you can not claim Child adoption is unless it is finished process.

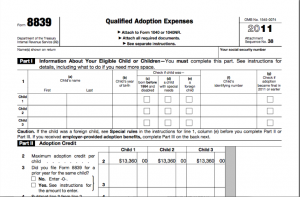

How To Claim Adoption Credit

You went through the process of adoption, now how to claim the credit. The IRS has Form 8839 for this purpose. You have to submit this form and the adoption documents, the adoption expenses with your tax return. Fill the Form 8839, the child’s name, and his/her birth year. You need to indicate whether or not the child has special needs, disabled, or is a foreign citizen.

Watch this video on how to claim the tax credit

You may claim the tax credit the year after you adopt or attempt to adopt a U.S. child. You could try to claim in the same year if you got it all done this year. If the child a US alien, you will need to claim the credit on the next year of the adoption. You can ask for the credit if you are in the middle of the process of adopting an American child.

Start Claiming Your Adoption Credit

The IRS grants thousands of claims for adoption credit every year. It is a generous way to show appreciation for those that take care of children that have no home that can give them what children need to grow up to adults that can have a decent life.

When we think about those people that can not have children of there own and compare the difficulties and the high cost of having an adopted child, the adoption credit is a way of helping them to have is not costly at all for most of the people, a baby. It is a generous way for the government to show appreciation for those who take it upon themselves to provide homes for unfortunate children.

Being eligible for adoption credit has an option for a late claim for the benefits. You can forward the claim for a later year when you will have tax liabilities that you can adjust with the tax credit for adoption.

We hope that the credit will become refundable in the future.

The children that need a new home and the families that need a new child, both will be happy. That makes the world a better place.

Do not forget to report the new child in your tax report as you would do with a newborn.

Tax Rules for Children and Dependents

paystumbmakr.com team thanks you for a visit and reading this blog Pays tub online

Learn how to create your pay stub

paystubmakr.com

Disclaimer: John Wolf and paystubmakr.com are making a total effort to offer accurate, competent, ethical HR management, employer, and workplace advice. We do not use the words of an attorney, and the content on the site is not given as legal advice. The website has readers from all US states, which all have different laws on these topics. The reader should look for legal advice before taking any action. The information presented on this website is offered as a general guide only