PRESENTED BY PAYSTUBMAKR.COM

05-24-2019

Financial modeling is used by businesses to forecast what will be the performance of a business in the future. A mathematical model is built on a spreadsheet based on records from the last years of activity and what we think will be the near future.

Financial Modeling For a Start-Ups

A startup founder will need to know how much money will be required for his baby to be a grown-up business. What time it may take to get the company to reach balance and revenue. Missing this knowledge can get the startup funding dry before reaching its goal. Without an excellent financial view and presentation, you can not get the funds you need, a bank or investor will first ask you about your financial projection or modeling.

Your Financial Model Will Help In This Ways

The primary financial model is called three Statement Model. To build a 3 Statement model, you need the Income, the balance, and the cash flow data of your startup. There are more complicated models such as discounted cash flow analysis model (DCF), that is too complicated for a stating business. A startup does not need that complicate model, a simple and easy to read Three Statement Model will be good enough for fast reading understanding.

When you go outside to look for finance or investment, you will need a document that will show the company finance in a way that will make it clear to the bank or investor. It is expected that you studied the financial model yourself before you go outside with it.

An example of fixed cost is the costs of the production itself, handling orders and shipping, marketing, advertising including online presence with celebrity endorsement and a blogger to endorse the product.

Modeling has to do with many different factors that take part in the activity of the startup — using the model for the study of different variables such as sales price per unit. Cost of delivery, and estimate the gross profit.

Using a spreadsheet and keep updating its data, will give you a live model that will respond to the realty anytime you look at the changes that your company is having by growing and maturing.

How Do You Start building your model?

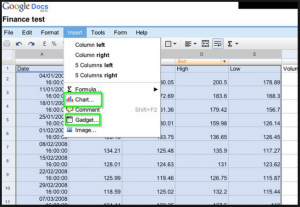

In this article, we will recommend to you how to start building your model. If you do not know how to use a spreadsheet, you can take an Excel class or an entire modeling class. If you are a busy technical inventor, creating new technology. You better save your time and hire one of those freelancers or ad hoc employee to do the job for you. That can do the someone that works for investors as a principal occupation.

Basic Modeling forecasting the Future of Your Startup

You are going to do in yourself, get a good template that matches your type of operation. Using a good template will save your time to build one. Do not stick blindly to the template; you may have some critical differences in your business. Excel is a recipient where you put the data and make readable the total factors of the finance of your business. Good Spreadsheet will make an excellent model, and functional data will make a correct model. The accurate model will help you make the right decision.

Formatting tricks to follow:

1. Use Color Codes in Your Spread Sheet

Colors will help you see what is what so use, blue for hard-coded inputs and black for variable formulas. Data that is not finally confirmed can stay in red until you confirmed about it.

2. Simplify Your Modle

Do not make the formulas to complex; make it simple so fewer errors will give you had time. Small steps calculations will do better than a complicated formula. Trying to make it all combined will make it sensible to mistakes.

3. Use the Basics

Take Excel class and train yourself up to the level that you would be able to use the CHOOSE function and the INDEX and MATCH to query data.

4. Label Everything

Remember that you will have to show the information to some people that may not be familiar with your business. Take seriously the labeling of the model logically. Sharing your model will be something you should expect if you are looking to expand the business.

5. Charts and Graphs Make Easier to Digest the Information.

“A picture says a thousand words” is always relevant concerning the presentation of complex statistical data and its analysis. Make a dashboard that will be “at a glance” understanding of the model most crucial information.

Summary

Once you have to model finished, start testing it with different scenarios to see the performance and to check that there is not a failed formula.

Formulas and graffs images and significant figures are good jobs, but not the reality of your business that is shown by the data analyzed by the model. The updated model will be your guide to success, your tool for bringing in new investors — your source of data for forecasting the future.

paystumbmakr.com team thanks you for a visit and reading this blog Paystub

Disclaimer: John Wolf and paystubmakr.com are making a total effort to offer accurate, competent, ethical HR management, employer, and workplace advice. We do not use the words of an attorney and the content on the site is not given as legal advice. The website has readers from all US states which all have different laws on these topics. The reader should look for legal advice before taking any action. The information presented on this website is offered as a general guide only and never as