Keeping your payroll pay stubs

Presented by Paystrubmakr.com  By John Wolf

By John Wolf

Paperwork is an ongoing chore in life, especially with recurring documents such as bank statements, household bills, and pay stubs, and it is crazy to see how they can pile up fast. Knowing which papers to store and which ones you can help with this little fact of life, as many people keep paperwork or documents that no longer serve any purpose, outside of taking up space. 2021 tax filing season begins Feb. 12; IRS outlines steps to speed refunds during the pandemic

Archive your pay stubs

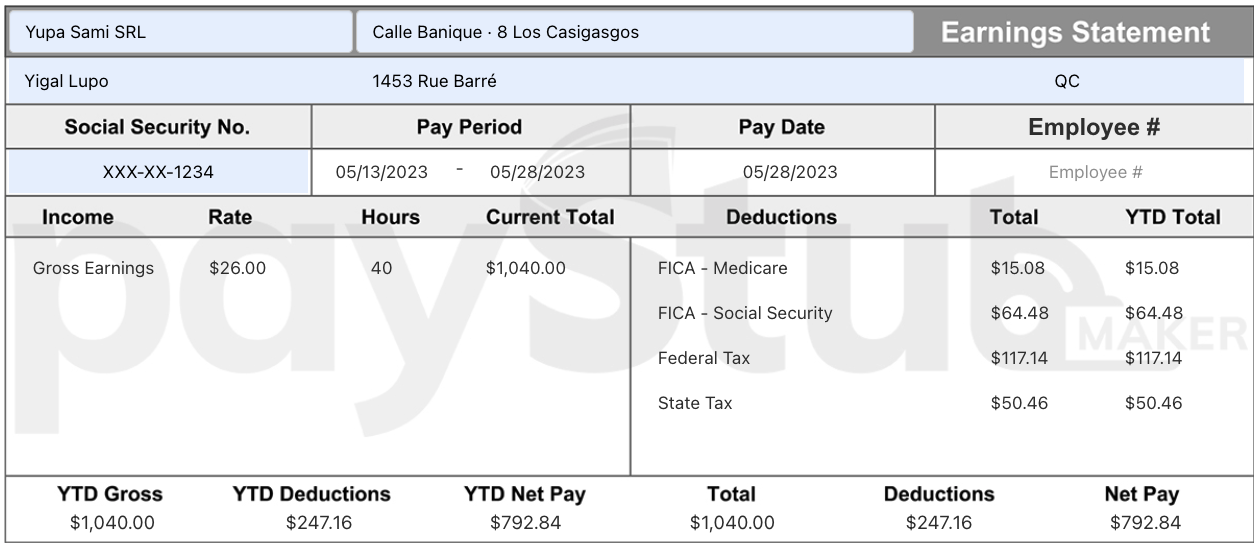

Pay stubs are documents that should be saved for a specific amount of time before discarding. These are very important documents as they contain your personal financial information, but once you receive an accurate Form W-2 from your employer by January 31st of each year, your pay stubs will no longer be quite as key, since all the financial data is summarized on the Form W-2. You should remember to compare your pay stubs to your W-2 to make sure that they tie out, as Employers do make mistakes here, particularly for contractors.

Pay Stubs and Taxes

When you receive a copy of Form W-2 from your employer at the end of the year, in particular, compare the figures on your last pay stub with the figures on your Form W-2. If the numbers match, then keep the W-2 form for tax filing purposes and discard all the old pay stubs. If the numbers do not match, then take the last pay stub or if necessary other pay stubs and Form W-2 to the person managing payroll, probably your Finance or HR department and have the numbers reconciled.

For How Long Should You Keep Pay Stubs?

When it comes to pay stubs, you should keep them for at least one year. Keep either a hard copy or a digital one of the past year’s worth of your monthly bank and credit card statements. You should also hold on to pay stubs so that you can use them to verify the accuracy of your Form W-2 when tax season arrives, as discussed above.

Items like your annual tax return should be filed away and kept for at least seven years, as the IRS has seven years to conduct an audit. Your pay stubs will come in very handy if the IRS does an audit, as income that is under-reported has an increased penalty during an audit.

Importance of Keeping Pay Stubs As Records

Many people are confused about how to get old check stubs when buying a new property. One thing to remember when a person is planning to buy a home, it is extra important for her or him to keep pay stubs for at least two months, but better still keep several months, as lenders will always request records of that information. Other documents that generally do not need to be kept for more than a year include utility bills, medical bills, bank statements, and credit card statements. However, if any of these may play a role in a tax file, they should be kept for seven years.

How Do You Dispose of These Records?

There are many pieces of information in your pay stub that would allow someone to steal your identity, so always treat your pay stub and the sensitive information it contains very carefully. With your name, address, and part or all of your Social Security Number, your pay stub shows enough for a criminal to cause you problems. In addition to this data, it shows your hourly rate or your salary and your year-to-date earnings, where you work, and benefit deductions. This can be a lot of information to end up in the hands of a stranger. So, you should dispose of your pay stubs by shredding them and preserve your privacy.

If you’re wondering how to print a copy of your check stubs, one way is to visit https://paystubmakr.com/ to generate and print your pay stubs without any hassle.

paystumbmakr.com team thanks you for a visit and reading this blog Pays tub online About pay stubs

Learn how to create your pay stub

paystubmakr.com

Disclaimer: John Wolf and paystubmakr.com are making a total effort to offer accurate, competent, ethical HR management, employer, and workplace advice. We do not use the words of an attorney, and the content on the site is not given as legal advice. The website has readers from all US states, which all have different laws on these topics. The reader should look for legal advice before taking any action. The information presented on this website is offered as a general guide only.