PRESENTED BY YOUR PAYSTUB MAKER

06-09-2019

Being a small business owner is a do it yourself style of work. You have to deal with Procurement as well as sales, Administration, and bookkeeping. The weekly or biweekly burden of the payroll.

Everyone that owns a small business knows well how that time is always not enough for a small business owner. A study made by Small Business trends 72 percent of small business owners report that they feel overwhelmed by the weight of managing their small business.

The accurate payroll calculation is critically important, making the balance of the working hours and the tax and Social Security withholding, and print the paystubs is time-consuming and tedious work. Your company may need to comply with the federal law and keep the payroll records. Your employees will ask for their paystub. The Leading Cause of Stress in Small Business.

Here you can see how easy it is to make an online paystub

Why Keeping Your Proof of Income or Pay Stub Is Important.

Every company that provides payroll services to the small business keeps them updated about the changes made by the State and Federal taxes regarding payroll tax and other withholdings.

The employers will receive from the payroll company the complete information on the payroll net to pay the employees and the withholdings to send to the local and federal tax collection institutions. The employees will receive a pay stub for them to keep as evidence of their tax paying and income. This system will let the employer of a small to deal with his day to day operation.

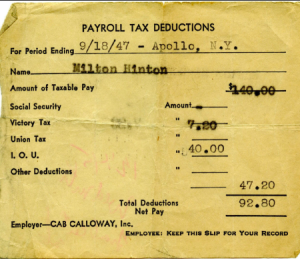

Employers should provide you with a pay stub, or as it can be called, pay slip, or a paycheck stub. These stubs are your proof of income, telling your employer’s details and your earnings for a pay period and what were your benefits and deductions. Therefore, you have to keep the paystubs for the day you will need to show that you have employment. And you produce your income and tax paid in the past.

What You Can do With Your pay stubs as proof of income:

- Show your savings plan (as part of the payroll deductions)

- Payment of loan installments (shown as payroll deductions)

- Child support pay

- Wage garnishments payments

- When you need to secure a home or car loan

- To refinance a mortgage

- For a credit card

- A retail store credit

- To rent a home or apartment

- As proof of having an employment

When we need to know somebody’s income proof, we will either look at the persons’ bank statement, wages or tax statements or the paystub of the lasts salaries. Presenting a paystub is the most common way to show every party or organization, the proof of the income. It is easier to use the paystub for they are in hand and shared by many applicants with the landlords. Some lender will ask for the last three or four paystubs as evidence of your income.

How to show a Pay Stub as a Proof of Salary?

Hourly workers can show the sequence of the time-periods by presenting at list six pay stubs of the last paychecks. Checking the dates on the pay stubs will add some assurance. Click here for your pay stub online.

We have good news; these days it is easier to manage the payroll online. When you go online to make a pay stub for employees online, and in a few minutes, get your payroll and its pay stubs. It is entirely made by you by using software that was created by professional software engineers. You will be able to finish the salary in a short time and deliver the paychecks and the professionally built pay stub to your employees.

Business Owners Must File the Records of the Payrolls

As an employer, the importance of keeping the pay stubs cannot be overstated. If you own or manage a small business with one employee or more, a company or partnership, you must comply with state and federal payroll laws. As the rule of the Equal Employment Opportunity Commission (EEOC), you must keep the employee record for some time. Avoid errors and disputes by managing your payroll records. In many states, the law permits managing the payroll in a wholly digital way, but it is an obligation to give the employee the option of a paper made pay stub.

The Data You Need to Create a Digital Pay Stub

Before you take a seat in front of the computer, make sure that you have the information for the computerized payroll preparation. Do not worry about the calculation of taxes and other withholding. The pay stub generator will do it all for you in the instant that you clicked start.

You need access to:

- The payor name and address (Employer)

- The payee personal identifying information (Employee’s SSN)

- Pay period date covered by the pay stub

- The total hours worked

- The rate paid per hour

The deductions will be calculated automatically by the software out of the total of hours x rate = net payment by a paycheck or bank transfer. The paystub will show all the details.

How Software Can Help You Generate Pay Stubs Instantly and Easily

A pencil and a notebook used to be the tool for preparing payroll and pay stubs. Later came the calculator and made it an easier task, but still, it was a tedious job. Now in the computer and Internet era, it can be a much easier and faster task. Nowadays we have to turn on the computer, look for the right Link feed the data into a template, pay and instantly look at the email inbox and print the pay stub, make the paycheck as the total to be paid appears on the pay stub. That is a natural, time-saving way to have your payroll made.

The deduction that will be automatically withheld

- FICA – Medicare

- FICA – Social Security

- Federal Tax

- State Tax

The program will handle all the calculation and formatting. The software knows the rate for every state, Marital Status, SS calculation. You need to input all the data correctly. The user needs only to input the information, check the preview, and move on to check out. The program is protected from an attack, so not licks of data can happen.

paystumbmakr.com team thanks you for a visit and reading this blog Paystub

Pay stub site

Disclaimer: John Wolf and paystubmakr.com are making a total effort to offer accurate, competent, ethical HR management, employer, and workplace advice. We do not use the words of an attorney and the content on the site is not given as legal advice. The website has readers from all US states which all have different laws on these topics. The reader should look for legal advice before taking any action. The information presented on this website is offered as a general guide only and never as