Presented by Paystrubmakr.com  By John Wolf and Tom Cullen CPA

By John Wolf and Tom Cullen CPA

Paystub Generator at your service brings you more information on Individual Plans by IRA

Individual Plans By IRA

The government wants to encourage everyone to save for retirement. Savings for this purpose also contributes to the formation of investment capital needed for economic growth. For many individuals, including those covered by corporate retirement plans, the IRA plays an essential role.

Employer and Employee Responsibilities – Employment Tax Enforcement

Deemed IRA

When an eligible retirement plan permits employees to make voluntary employee contributions to a separate account or annuity that:

(1) is established under the plan.

(2) meets the requirements that apply to either traditional IRAs or Roth IRAs, then the separate account or annuity is deemed a traditional IRA or a Roth IRA for all purposes of the code (§408).

How many payrolls passed before the worker became old?

Watch video! Pre-Approved Plans Opinion Letter Program (Revenue Procedure 2017-41)

Deemed IRA

When an eligible retirement plan permits employees to make voluntary employee contributions to a separate account or annuity that:

(1) is established under the plan.

(2) meets the requirements that apply to either traditional IRAs or Roth IRAs, then the separate account or annuity is deemed a traditional IRA or a Roth IRA for all purposes of the code (§408).

Here you make your low-cost Paystubs.

Here you make your low-cost Paystubs.

Record keeping & Reporting by the United States DEPARTMENT OF LABOR

Mechanics

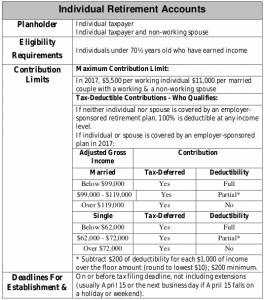

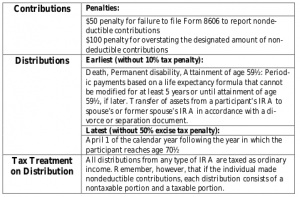

Any individual whether presently participating in a qualified retirement plan can set up an individual retirement plan (IRA) and take a deduction from gross All Postsincome equal to the least of $5,500 (in 2017) or 100% of compensation. Individuals age 50 and older may make additional catch-up IRA contributions. The maximum contribution limit (before application of adjusted gross income phase-out limits) for an individual who has celebrated his or her 50th birthday before the end of the tax year is increased by $500 for 2002 through 2005, and $1,000 for 2006 and later.

Note: One way in which taxation of a lump-sum distribution may be postponed is by transferring it within 60 days of receipt of payment into an IRA. This delays the tax until the funds are withdrawn.

Educational Level and Pay by United States DEPARTMENT OF LABOR

Phase-out

The taxpayer and spouse must be nonactive participants to obtain the full benefits of an IRA. If either is an active participant in another qualified plan, the deduction limitation is phased out proportionately between $99,000 and $119,000 of AGI in 2017. For single and head of household taxpayers, the phase-out is between $62,000 and $72,000 in 2017 (up from $61,000 and $71,000 of AGI in 2016).

AGI

AGI is determined by taking into account §469 passive losses and §86 taxable Social Security benefits and ignoring any §911 exclusion and IRA deduction.

Special Spousal Participation Rule – §219(g)(1)

Deductible contributions are permitted for spouses of individuals who are in an employer-sponsored retirement plan. However, the deduction is phased out for taxpayers with AGI between $186,000 and $196,000 (in 2017).

Back pay, A common remedy for wage violations by the United States DEPARTMENT OF LABOR

If a taxpayer files a joint return and their compensation is less than that of their spouse, the maximum that can be contributed for the year to the taxpayer’s IRA is the least of:

(1) $5,500 in 2017 (or $6,500 in 2017 if taxpayer is 50 or older), or

(2) Total compensation includable in the total income of both taxpayer and their spouse for one year reduced as follows:

(a) To a spouse’s IRA contribution for the year to a traditional IRA, and

(b) Contributions made for one year to a Roth IRA on behalf of the spouse.

Combined this means that the total contributions that can be made for the year to a taxpayer’s IRA and their spouse’s IRA can be up to $11,000 in 2017, or $12,000 in 2017 if only one spouse is 50 or older, or $13,000 in 2017 if both spouses are 50 or older. Or $13,000 in 2017 if both spouses are 50 or older. An individual can have a traditional IRA whether any other retirement plan covers them. Anyhow, a taxpayer may not be able to deduct all of their contributions if an employer retirement plan coverage of a taxpayer or their spouse.

paystumbmakr.com team thanks you for a visit and reading this blog Pays tub online About pay stubs

Learn how to create your pay stub

paystubmakr.com

Disclaimer: John Wolf and paystubmakr.com are making a total effort to offer accurate, competent, ethical HR management, employer, and workplace advice. We do not use the words of an attorney, and the content on the site is not given as legal advice. The website has readers from all US states, which all have different laws on these topics. The reader should look for legal advice before taking any action. The information presented on this website is offered as a general guide only.