Presented by Paystrubmakr.com  By John Wolf

By John Wolf

PAY-STUB MAKER give you more to read more about S Corporation

Domestic Corporation

An S corporation must be a corporation that is either organized in the United States or organized under federal or state law. The term “corporation” includes a joint-stock company, certain insurance companies, or an association that has the characteristics of a corporation. Certain domestic corporations are ineligible to elect S corporation status.

A drink by the barman. A pay stub by the employer

They are:

(a) A member of an affiliated group of corporations; Quote from 2016 Arizona Corporation Income Tax Return

(b) A DISC (Domestic International Sales Corporation) or former DISC;

(c) A corporation that takes the Puerto Rico and possessions tax credit for doing business in a United States possession;

(d) A financial institution that is not a qualified bank, including mutual savings banks, cooperative banks, and domestic building and loan associations; and(e) An insurance company taxed under Subchapter L (§1361(b)(2)). Effective for taxable years beginning after December 31, 1996, the term “ineligible corporation” means any corporation that is:

(a) A financial institution that uses the reserve method of accounting for bad debts described in §585,

Note: A bank (as defined in §581) is allowed to be an eligible shareholder

unless it uses a reserve method of accounting for bad debts.

(b) An insurance company subject to tax under subchapter L,

(c) A corporation to which an election under §936 applies, or

(d) A DISC or former DISC (§1361(b)(2)).

Paystub Generator at your service

Paystub Generator at your service

Election Requirement

An S corporation must correctly elect to be taxed under subchapter S, and the election must not have been previously terminated.

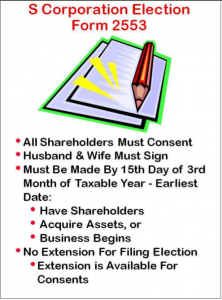

Making the Election

The corporation may make the election at any time during the preceding taxable year or at any time before the 15th day of the 3rd month of the taxable year (for convenience, this is referred to as March 15, since most S corporations must use the calendar year). If made after March 15, the election is treated as made for the following year (§1362(b)). All persons who are shareholders on the date the election is filed must consent to the election. However, the election will be valid for the year in which it is made only if consent is obtained from all persons who have been shareholders during the tax year up to the date of the election (§1362(b)(2)(B)(ii)).

Note: If some shareholders consent after March 15, the election goes into effect the following year (§1362(a)(2), (b)(2)).

Form 2553

To file for the election, shareholders need to complete Form 2553 and provide their personal information such as their names, social security numbers, stock ownership, and tax year. Each shareholder must sign their own consent on the form, even if they co-own shares with someone else. If a minor is involved, their legal representative or natural/adoptive parent must provide consent. An executor or administrator of an estate must provide consent for an estate holding stock. For a qualified trust holding stock, each person treated as a shareholder must provide consent. Shareholders may also choose to sign a separate consent statement and attach it to Form 2553.

separate consent should provide the following information:

(1) The name, address, and identification number of the corporation;

(2) The name, address, and identification number of the shareholder;

(3) The number of shares of stock owned by the shareholder and the date or dates acquired; and

(4) The day and month of the end of each shareholder’s tax year.

Invalid S Elections

For taxable years beginning after December 31, 1982, the IRS may treat a late subchapter election as times when the IRS determines that there was reasonable cause for the failure to make the election on a timely basis §1362(b)(5)).

Extension

If the corporation’s election would be valid except for the failure of a shareholder to file a consent on time, that shareholder may apply for an extension of time to file the consent. The request for an extension of time to file should be sent to the Internal Revenue Service Center where Form 2553 was filed.

The time for filing a consent may be extended if:

(i) It is shown to IRS’s satisfaction that there was reasonable cause for the failure to file the consent and that the government’s interest will not be jeopardized by treating the election of S corporation status as valid,

(ii) The shareholder who did not file a proper consent files the proper consent within the extended time granted by the IRS, and

(iii) All shareholders file new consents within the extended time. All shareholders include anyone shareholder during the period for which the extension is granted.

Events That Cause the Termination of an S Corporation

S Corporation Termination

A corporation’s status as an S corporation may be terminated by:

(1) Revoking the election,

(2) Ceasing to qualify as an S corporation, or

(3) Violating the passive investment income restrictions on S corporations with pre-S corporation earnings and profits. Terminations are generally effective on the date of the terminating event. If a corporation’s status as an S corporation has been terminated, it generally must wait 5 tax years before it can again become an S corporation. If it gets the permission of the IRS, the waiting period may be less than 5 years (§1362(g)).

Note: Under the Small Business Act of 1996, any termination of S status before August 20, 1996, is not taken into account. Thus, any small business corporation that terminated its S corporation status within the five-year period

before August 20, 1996, may re-elect S status.

If the corporation is terminated because it inadvertently ceased to qualify as an S corporation or because it inadvertently violated the restriction on passive investment income, the IRS may waive the termination ((§1362(f)). The termination may be waived if the IRS determines that the termination was inadvertent, the corporation takes steps to correct the event within a reasonable period of

time, and the corporation and its shareholders agree to be treated as if the event had not happened.

The corporation may request a determination in the form of a ruling request whether the termination was inadvertent by following the procedures set out in R.P 90-1. There is a charge for this ruling.

Revoking the Election

The corporation may revoke an S corporation election for any tax year. However, it can be revoked only if shareholders who collectively own more than 50% of the outstanding shares in the S corporation’s stock consent to the revocation. The consenting shareholders must own their stock in the S corporation at the time the revocation is made.

paystumbmakr.com team thanks you for a visit and reading this blog Pays tub online About pay stubs

Learn how to create your pay stub

paystubmakr.com

You can build your pay stub right now. It is an instant pay stub. A real check stub with your deductions and income. As soon as you provide payment, you can print it, download it, and we’ll email it to you just to make sure!

Paystub Maker team thanks you for reading its Blog

The next Blog will tell you more about S Corporation.