Presented by Paystrubmakr.com ![]() By John Wolf and Tom Cullen CPA

By John Wolf and Tom Cullen CPA

Rabbi Trust PLR 8113107

Rabbi Trust

This letter ruling involved a congregation that seeks to establish a trust for the benefit of a rabbi. Amounts placed in 8-16 the trust were invested and managed by trustees. The net income was paid to the rabbi at least quarterly. Principal and income of the trust would be distributed upon the rabbi’s death, disability, or termination of his services. The trust asset was subject to the claims of the congregation’s general creditors, and the rabbi could not assign, alienate or pledge the trust property. Also, the trust property was not subject to any claims that the rabbi’s creditors might have. The Service held that the rabbi did not actually or constructively receive income, or economic benefit, from the placement of the property into the trust. Such amounts would only be included in income when received or made available to the rabbi.

The Rabbi is not only a religious persona, but he also acts as a disputes judge.

Giving New Life To Life Insurance Forbes

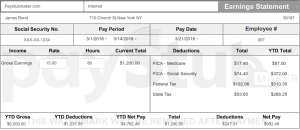

Paystubs easy to make just a few clicks and it is done

Paystubs easy to make just a few clicks and it is done

Some practitioners take the position that if the employee directs the investment of assets held by the employer, this could be interpreted by the IRS as an exercise of the “rights” over those funds. Thus, the IRS could assert that the employee essentially “owns” the funds, and should pay tax on them. If this is a Conglomerate or if the “employee” is also a shareholder in the corporation, the ongoing management of such assets might be left in the hands of a mutual fund manager, insurance company, or other third parties.

Five things to know about the gender paycheck gap Video by CNN

Your low-cost Paystubs Generator.

Your low-cost Paystubs Generator.

Life Insurance

The employee will not have any rights or interest in the policy. Therefore, policy values can be attributed to the employee only by disregarding the corporation which the courts have not done (Casale v. Comm., 26 T.C. 1020 (1956); and R.R.59-184). In fact, under R.R. 68-99, the Service ruled that an employer may, at its option, purchase a life insurance policy to fund a deferred-compensation arrangement. The ruling requires that all rights to any benefits under the insurance contract are solely the property of the employer, and the proceeds of the contract are payable by the insurance company only to the employer. Thus, the employee does not receive a present economic benefit from the policy, and consequently, the basic concept of deferral is not defeated by the insurance funding (R.R. 72-25).

Your life insurance is paid by every total paystub pay.

Premiums

When the employer pays the premium of life insurance policy are not taxable to the employee because he has no rights or interest in the policy. This is so even though the employer uses the proceeds of the policy o discharge its obligation under the deferred compensation agreement Centre v. Comm., 55 T.C. 16 (1970)).

Tax Reform Sparks Interest In Life Insurance and Secondary Markets Jamie Hopkins Forbes

Note that the premium payments would not be deductible by the employer (§264(a)(i)). Nevertheless, the life insurance proceeds received by the employer upon the employee’s death would be income tax-free (§101(a)). The company is simply transferring some of its cash assets into a cash-value account that it controls. However, life insurance premiums paid by an employer on the life of the employee under the circumstance where the proceeds are payable to the employee’s beneficiaries will result in current taxable income to the employee (Reg. §1.61-(2)(d) and Paul L. Frost, 52 T.C. 89 (1969)). Finally, if the policy is transferred to the employee upon termination of employment, he will be taxable on the value of the policy received at that time.

Missing Your W-2? Here’s What to Do IRS

Third-Party Guarantees

The guarantee of the employer’s obligation by a third party does not appear to affect the ability to defer the compensation. In Robinson v. Commissioner, 44 T.C. 20 (1965), acq., deferred compensation for a boxer was personally guaranteed by the president of the promotional corporation. The Tax Court held that the taxpayer did not constructively receive funds payable in subsequent years under the deferral agreement.

Surety Bond

It is not uncommon for executives of large corporations to purchase a surety bond protecting their interest in unfunded and unsecured deferred compensation plans. Sometimes these bonds are purchased by the corporation on behalf of the executive. If the executive purchases the bond, the question arises whether the bond “secures” the employer’s promise to pay future benefits in the same way as collateral or a promissory note. If the employee purchases the bond, then the employee (and not the corporation) is securing the payment of the deferred compensation benefits, and no adverse tax consequences should arise. If the bond is purchased by the employer, the question arises whether the cost of the bond (i.e., the premiums) constitutes a taxable “benefit” to the employee. If the corporation pays for the bond, however, the corporation is fundamentally committing its assets to secure the payment, similar to funding. To avoid the IRS attacking the corporation should establish that it was purchasing the bond on behalf of the employee, upon the employee’s choice or direction. The cost of the bond, furthermore, should show up on the W-2 of the employee as an imputed premium. 8-18

Paystub Maker Team thanks you for visiting its Website and reading the blog.

For any question or advice about our service, please write us.