Making Pay Stubs Easier in 2023

Pay Stubs generating

Presented by Paystrubmakr.com By John Wolf

Managing payroll can be a difficult task.

Calculating wages, deductions, contractor rates, vacation days, and keeping up with regulations can make processing payroll overwhelming for employers. Simplified payroll solutions may be necessary for small businesses to meet their needs.

Shifting To the Home Office

As a small business shifted to a home-based team, generating pay stubs has become an additional online task. To simplify this process, check out paystubmkr.com. This online service provides an easy and user-friendly tool for administrators to generate pay stubs according to their business needs. All you need to do is input the employee’s hours, rate, and personal information and check out. The pay stubs will be sent to the employee via email instantly.

Effective cut costs and efficiently manage their employees.

It’s understandable why business owners seek effective strategies to cut costs and efficiently manage their employees, the organization’s most valuable resources, to enhance productivity. Most of all, other preliminaries must be taken care of, including all the nitty-gritty details of running a business! Most small business owners typically write checks for their employees’ salaries every pay cycle without realizing the need to preserve a record of employee earnings. Sometimes business owners need to recognize that the company’s efficiency is improved when employers have documentation demonstrating tax and other payroll deductions since government agencies and other outside parties often request this. Pay stubs are the answer; business owners should ensure they understand the best ways to use them. Payroll Taxes in 2023

What is Pay Stubs?

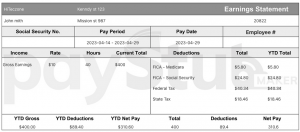

A pay stub is a document included in a paycheck that provides a comprehensive breakdown of an employee’s earnings. It outlines the wages earned for the current pay period and the year-to-date payroll. It also itemizes any taxes and deductions subtracted from the employee’s earnings. Lastly, the pay stub indicates the amount of net pay the employee will receive.

Employers can enhance payroll management by providing employees with electronic or printed pay stubs. In certain states, it is mandatory to provide pay stubs, and the specific information required on them varies by state. Additionally, employers can retain a copy of each payroll stub for future record-keeping purposes.

The Use of Pay stubs

A pay stub provides essential information for employers and employees to understand how payroll runs affect them. Employees can use it to see their deductions and ensure they are paid accurately. Additionally, reviewing past pay stubs can help resolve any discrepancies in pay.

Information in a pay stub

A pay stub contains various details that aid the employer and employee in keeping track of payments and deductions. Typically, these details can be divided into three main categories:

• Gross wages

Gross pay is the total amount of money an employee has earned before any deductions are taken. This amount can be calculated based on the employee’s hourly rate and the number of hours worked.

• Taxes, deductions, and contributions

Gross wages, taxes, and deductions are divided into two categories on pay stubs: current deductions and year-to-date amounts. Tax deductions usually include the following:

- Employee tax deductions.

- Employee deductions for benefit contributions.

- Employee contributions to specific savings plans.

Net pay

In this section, you can find the amount an employee takes home after subtracting all deductions from their gross pay. Paycheck stubs also show the employee’s regular working hours and gross pay rate.

Informing your employees

Pay stubs inform employees about their pay and deductions and serve as a record of tax payments and other essential details.

Many online pay stub generator websites offer the online service of generating online check stubs quickly. Many software programs have similar templates and functionalities, and accounting software packages can create pay stubs conveniently, making the payroll process smooth and easy.

paystumbmakr.com team, thank you for your visit and for reading this blog Pays stub online About pay stubs