Presented by Paystrubmakr.com By John Wolf

About payroll managing

Administering Payroll can pose a formidable challenge. Computation of wages, deductions, contractor remunerations, vacation entitlements, and staying abreast of regulations can render payroll processing an arduous task for employers. For small businesses, simplified payroll solutions may be imperative to cater to their specific requirements.

Transitioning to a remote work environment has added the generation of pay stubs as an extra online responsibility. To streamline this procedure, consider utilizing paystubmkr.com. This online service offers a straightforward and user-friendly tool for administrators to create pay stubs tailored to their business needs. Input the employee’s hours, rate, and personal details, and the pay stubs will be promptly emailed to the employee. What Is Payroll, With Step-by-Step Calculation of Payroll Taxes.

Human resources

Effectively curbing expenses while efficiently overseeing personnel is a priority for business proprietors. Recognizing the necessity to document employee earnings, especially for tax and payroll deductions, is crucial for enhancing organizational efficiency. Pay stubs play a pivotal role in this regard, and business owners should be well-versed in optimizing their use.

What Are Pay Stubs?

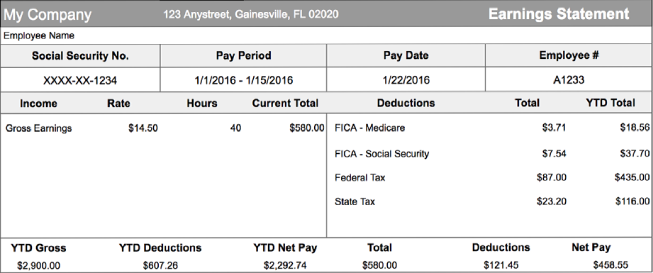

A pay stub, included in a paycheck, furnishes a comprehensive breakdown of an employee’s earnings. It delineates the wages earned during the current pay period and the year-to-date payroll. Additionally, it itemizes taxes and deductions subtracted from the earnings, culminating in the employee’s net pay. Read What Is A Pay Stub & What Should It Include?

Employers can enhance payroll management by furnishing employees with electronic or printed pay stubs. Providing pay stubs is mandatory in certain states, with specific information requirements varying by state. Retaining copies of each payroll stub for future record-keeping is also advisable.

Utilizing Pay Stubs

Pay stubs offer crucial insights for both employers and employees, aiding in understanding the impact of payroll processes. Employees can verify deductions and ensure accurate payment while reviewing past pay stubs, which facilitates resolving discrepancies.

Information contained in a Pay Stub

A pay stub encompasses various details categorized into three main sections:

- Gross Wages: The total earnings before deductions, calculated based on an hourly rate and worked hours.

- Taxes, Deductions, and Contributions: Current and year-to-date amounts for tax deductions, benefit contributions, and savings plans.

- Net Pay: After deducting all applicable amounts from gross pay, an employee receives.

Informing Employees

The pay stub, also known as a pay slip or paycheck stub, is a detailed document that shows an employee’s earnings and deductions for a specific pay period. It contains the following information:

– Employee Information: The name of the employee, their personal identifier (such as an employee ID or Social Security number), and the time period for which they are being paid.

– Gross Wages: The total amount earned by the employee before any deductions, broken down by regular and overtime hours worked and the hourly rate or salary.

– Taxes: The amount of federal, state, and local income tax withheld, as well as deductions for Social Security and Medicare taxes.

– Deductions: The amount deducted for health insurance premiums, retirement contributions, other benefits, and court-ordered garnishments.

– Contributions: The amount contributed by the employer on behalf of the employee, such as matching contributions to retirement plans.

– Net Pay: The amount the employee receives after all deductions and taxes have been subtracted from gross earnings.

– Year-to-Date (YTD) Information: The total earnings and deductions for the employee since the beginning of the calendar year.

This information is important for employees to understand their earnings and deductions, and for employers to keep accurate records and comply with regulations. Read about Top 8 Reasons to Make a Paystub