PAYSTUBMAKR.COM presents, How to pay yourself. For the 2017 tax law.

You have to manage your small business, having a lot of different responsibilities on your shoulders, you deserve being well paid, but you need to know how to pay yourself while taking the advantages the tax law permits you.

Salaries, dividends, loans, and owners draw the forms to get money from your own company; each type has its different tax implications when you run payroll that includes yourself as a self-employed. We will review the difference between the options.

A small business owner can be on payroll or make a draw

Your business entity structure makes a difference here is how:

-

A sole proprietorship is the most basic legal entity for business. Assets and liabilities are the owner’s property, and responsibility, the company and you are practically one including your tax filing. Tax is calculated on all the income together. Schedule C and the standard Form 1040. You will need to make and pay the estimated tax payments quarterly. Sole Proprietorship

-

The partnership is like its name tells us, a group of people that are partners in a business. Partnerships do not pay income taxes as one entity. The partners pay for their part in the benefits of the partnership, a pass-through. A partnership files Form 1065 and Schedule K-1 for the respective partners. Liability is the same as for a sole owner; it is divided between the partners as their part in the business. Partnership

-

Limited liability corporation (LLC) is the more simple option of a corporation. It is the combination of pass-through taxation of a partnership and limited liability of a corporation. An LLC can be taxed as a corporation or pass through the profits to the owners’ income tax filing. Ask your tax adviser about the state and federal issues apart, make sure you know and understand all the aspects correctly. Limited liability company

.

-

Cooperative is similar to LLC, a corporation that may pay or not pay federal taxes; it can pass-through its profit to its members. The difference of a cooperative with other legal entities is that the members democratically take the decisions. Cooperative

-

S corporation allows you to separate its tax from the owners or use pass-through taxing its partners individually. When an S corporation is taxed as an entity, the owner and employees are taxed only on their wages. Though, you have the option of an LLC to file as an S corporation for taxation. S Corporation

-

C corporation it is the less popular among small business because it is much more complicated than the other types of legal entities. The C corporations are very complicated to manage and have costly administration. The primary disadvantage is the “double taxation” first it pay the taxes as an entity and later as an individual. Startups prefer the C corporation because it can offer stocks. C Corporation

Pay yourself as an owner of a small business

We review the different businesses structures or legal entities; now we will see the different options for paying yourself with each type of legal entity.

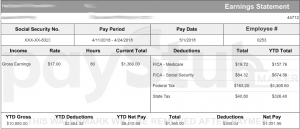

It is common to use the w-2 employee form of paying salary to employees, and you are one of them, that make $600 or more. W-2 employees pay the taxes through withholding on the payroll, shown on the paystub. There are rules and rates for payroll withholding.

IRS withholding calculator or use paystubmakr.com can help you make the right tax collection for the IRS

There are three factors to take into account when you prepare the paychecks for payroll:

-

Marital status

-

Allowances claimed on the W-4

-

Compensation, (according to the state) you should be paying yourself a reasonable wage and withhold taxes and Social security accordingly. Note that the IRS will check on a business that the owner is not paying himself reasonable compensation to avoid withholding taxes.

PAYSTUBMAKR IS YOUR PAYROLL MATE

PAYSTUBMAKR IS YOUR PAYROLL MATE -

A dividend can be received by the owner or owners if it is a return of capital to a shareholder it is not taxed. A dividend can be paid with cash or stocks. When the dividend origin is the benefits of the business, it is taxable.

-

Shareholder loan you can choose to take a loan from your own company. It must be a real loan with stated interest, maturity date, market interest. It is a possibility that the IRS will be treating the loan as a gift or dividend, wage or other taxable income.

-

Owner’s draw you can choose to draw as an owner or partner, it will be taxed on your tax filing. It is not like a W-2 wage that the company has to make the withholding of taxes. When you take an owners-draw, you have to pay all the taxes by your tax return and, the self-employment tax collects Social Security and Medicare contributions. What Is an Owner’s Draw and How Does It Work? As a small business, you need a good bookkeeper and a trusted tax adviser to see what is better for your small business; you can be that savvy and experienced in accounting and taxation, let the pros do their job and save you from falling into a problem with tax authorities. S company can pay the owner W-2 employee.

three clicks and you have a paystub

three clicks and you have a paystub

Open eye!

As a small business owner, you need to have a professional backup on all the aspects of the management, You may be an expert in the production part of your business like being a good sales executive or a chef, a graphic designer or a programmer but you can not be a professional accountant, tax adviser or human resource expert. Do not make a mistake to take decisions without consulting the team of professionals that you should have to back you up on all the mater that you are not highly trained to manage. You will not let your accountant do your professional job as a graphic designer do not do the accountant job. Building and working with a team of highly skilled workers or supporting consultants if the most important trait you need to have for making your business a success.