PAYSTUB MAKER team presents you with knolage about the new tax law.

Dates, Congress passed the new tax cuts and Jobs Act

On Dec 18, 2017, the Congress passed the new tax cuts and Jobs Act, and the President has signed it Dec 22, 2017. The approved bill is significantly different than the first drafts made by house and Senate. Individual taxpayers should take note of some essential changes and its effects on their tax filing and contributions.

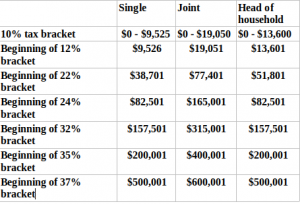

A. Individual tax rates brackets.

The new rates and brackets are taking effect starting 2018 up to 2025. Six of the seven brackets have lower rate up to 2026. The present rate brackets under the new law can be seen below.

The majority of the independent taxpayers are going to benefit from the changes in rate brackets. Those taxpayers that are now in the 33% marginal tax bracket will be in the 35% marginal tax bracket for the next year. The change will affect heads of family and singles between $200,000 to $400,000 taxable income. Below $200,000 taxable income. When income is below $200,000, it will compensate part or all of bad effect of being in the 35% Bracket marginal bracket.

There is no first pay stub for the first work-for-pay exchange by Wikipedia

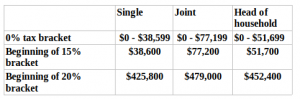

B. Long-term capital gains and dividends have no changes. The new law keep retains the existing 0%, 15% and 20% tax rates on long-term capital gains and dividends. For 2018, the rate brackets are as follows.

The year-end planning impact: After the changes in the tax law there is only a small difference between the brackets. The change was made in the way to calculate the adjustment of the inflation for the year 2018. Year-end tax planning strategies for taxable brokerage firm accounts still apply.

C. There is no obligatory application of FIFO rule for stock basis.

The Senate proposal to change FIFO rule did not pass. No need for spacial planning for year-end.

D. The new law has more deduction but not exemption deductions for personal and dependent.

The new law closely multiplies the “standard deduction amounts,” For this year. Nevertheless, those deductions that cloud have been $4,150 for 2018 unless the Congress eliminated them. This changes will favor some taxpayers and will not benefit others. The 2018 standard deduction amounts shown below.

- Singles $12,000 higher than the $6,350 for 2017.

- Joint-filing married couples $24,000 higher than for $12,700.

- For heads of households $18,000 higher than $9,350.

- Elderly and blind are allowed additional deduction amounts.

The Brief History of Checking (Using Checks as For Money Paychecks)

Here you make your low-cost Paystubs.

Here you make your low-cost Paystubs.

E. State and local taxes have new limits on deductions

The past law permitted the taxpayer to claim an unlimited itemized deduction for the state, local or property revenue. A taxpayer could choose not to claim for deduction of state and local income taxes but deduct from local general sales tax.

After the beginning of 2018, the new law will limit the deduction of state, local, and property taxes to the total of $10,000 or $5,000 for a married person that files separately.

Real estate property taxes in a foreign country will not be deducted anymore, yet you can use it instead deducting local sales tax. State and local taxes used to be planed for prepaying at year-end instead of at the beginning of the new year. This way you got the higher return for the present year. The new law, do not let you taking advantage prepaying state and local taxes. It is somehow vague how it is going to be enforced.: IRS says that only these 2018 property taxes can be prepaid in 2017.

F. Home mortgage new limits for interest deductions

At the beginning of 2018, the new law brought a reduction of the maximum amount of mortgage debt. For the first and second home to a single $1 million, married filing separate status $500,000, The change takes effect on homes acquisition mortgage made no later than Dec. 16, 2017, and the home purchased earlier than April 1st, 2018.

G. No change in the exclusion rules on home sales gain.

There is a valuable break with the new law allowing you to exclude from federal income taxation up to $250,000 from a qualified home sale. If you are a married joint-filer, it will be $500,000.

H. Medical expenses deduction expanded for 2017 and 2018.

The deduction is preserved by the new law. Furthermore, the new law expands covering expenses for medical cases over 7.5% of adjusted gross income (AGI) for 2017 including 2018, changing the old law 10% of AGI. Impact on year-end planning: To gain a last-minute advantage as a higher deduction, you should use elective medical expenses as vision and dental treatments before the end of the year.

I. More about what was changed and didn’t changed in the new tax law

1) The conversion of IRA into a Roth account is not allowed to be reversed. The old law let you reverse the conversion before the 15th of October of the year after. There is an unclear situation about this rule starting point, is it 2017 to 2018 or 2018 to 2019. If you have a pending conversion, you better do it before the end of the year.

2) Individual alternative minimum tax (AMT) suffered no changes in the new law, except an increase in AMT exemption deductions at incomes of a much higher level. For the next tax year, AMT exposure is because of state and local income, property taxes and deduction for dependent exemption. The new rule that limits on state and local taxes deduction and eliminates personal and dependent exemption deductions bring bigger AMT exemption deductions. The new law will affect less those taxpayers that were unfortunate by AMT in the old law.

3) In case of having a qualified child, you get a maximum credit of $2,000 per child. You can collect up to $1,400 as refundable money when you owe nothing to federal income tax. There is a nonrefundable $500 for non-child dependent.

The History Of Taxes In The U.S.

In case of having a qualified child

- The new law eliminated the deduction for moving expenses and most miscellaneous itemized expenses.

- The new bill eliminates the itemized deductions for personal casualty and theft losses except for a federal declaration of a disaster.

- Starting in 2019 Alimony will not be deducted if the divorce agreement took effect after 12/31/18. Double taxation is avoided by not including nondeductible payments in taxable income.

- Tax on adoption expenses stays the same.

- Electric plug-in vehicles are preserving its tax credit, See link Electric Vehicles: Tax Credits and Other Incentives

- Unified federal gift and estate tax exemption were doubled by the new bill, from $11.2 million to $22.4 million, starting in 2018.

Here you can see the changes 2018-tax-brackets 2017-tax-brackets

There will be more to learn about the new legislation made by the US Congress influence on taxation. PAYSTUB MAKER will keep you informed.