PAYSTUBMAKR. Presenting; Deducting of Repairs and Maintenance Expenses From Tax report.

Property needs to maintain, and repairs should be made to keep the property function and not deteriorated by use and time. The expenses made for the repairing and maintaining your property can be deducted from your income tax report.

Restauration of an old building

In the year 2014, the IRS issued new regulations that tighten up the rules about repairs and maintenance expenses deductions.

Repairs that improved or made a change in the use of the property or equipment are treated as an investment and will be depreciated over a few years, the routine works as painting curing or reporting can be deducted on the same tax year

Pay your payroll tax and print a paystub

Pay your payroll tax and print a paystub

The Basics

Routine Repairs and Maintenance like giving Service, cleaning, or other repair jobs that you do to your assets can be deducted in the same year you spend the money. (IRS.gov, Publication 535, Business Expenses, chapter 7, section on Repair and Maintenance Costs.)

Auto repair

In another section of Publication 535, the IRS clarifies the distinction between maintenance and repairs:

“Repairs. The cost of repairing or improving property used in your trade or business is either a deductible or capital expense. Routine maintenance that keeps your property in a normal efficient operating condition, but that does not materially increase the value or substantially prolong the useful life of the property, is deductible in the year that it is incurred. Otherwise, the cost must be capitalized and depreciated.” (IRS.gov, Publication 535, Business Expenses, chapter 11, section on Repairs.)

The IRS definition of routine maintenance is; “Anything that keeps your property in good operative condition and avoids deterioration or damage.

Car maintenance includes the oil changing that make the engine work well and avoids the destruction of it plus being a routine action which means a 100% deductible expenses. An over whole engine repair or a new transmission are prolonging the car life substantially. Therefore it needs to be capitalized.

Our Generator instantly makes you a paystub

Our Generator instantly makes you a paystub

Property needs to maintain, and repairs should be made to keep the property function and not deteriorated by use and time. The expenses made for the repairing and maintaining your property can be deducted from your income tax report. The BRA Test Repair Regulation Relief: What Does It Mean? (Not As Much As You Think)

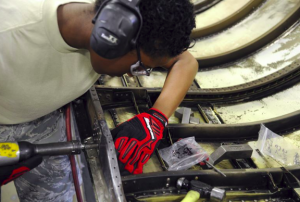

Air Plane repairs

When you only restore you the property you bring it to its normal condition as it was new.

A new roof is a clear case of restoration, here are some notes about what are restorations:

-

Replacing a deteriorated property that is brought back to operation conditions.

-

Replacing structural parts or major components.

-

Rebuilding de asset back to be like new.

Adapting is repairing a property to be used in new ways

For example, changing a property from production use to retail sales need to be capitalized and filed like an investment. The IRS says. Adaptation expense is “An amount spent to change a property use to a new using way, if the adaptation is not consistent with your ordinary use of the unit of property at the time you originally placed it in service” (from the What adapts the unit of property to a new or different use? section of the Tangible Property Final Regulations Q&A).

Instantly creates your paystub

Instantly creates your paystub

The three Rules for Safe Harbor

The rule says, “Expenses for repair and maintenance need to be capitalized and depreciated” The rule has three exceptions or “safe harbors as the IRS call it. To use the exceptions you need to make a formal election and attach it to the tax return. attaching an election statement

For a small business, the safe harbor is $2,500 immediate deduction per item or invoice

Up to $2,500 Safe Harbor Election for Small Taxpayers.

You can immediately deduct repair and maintenance expenses

For more information, you can see de minimis safe harbor election.

Small Taxpayers Safe Harbor

You can use the safe harbor if the total amount of repairs is less than $10 thousand, or 2% of the unadjusted basis of the asset the lower amount. This safe harbor is allowed only to the taxpayer that their revenue is under $10,000,000 and the property is less than $1 million.

For more details on this provision, see the safe harbor election for small taxpayers section of the Q&A on the IRS Web site.

Safe Harbor for Routine Maintenance

When the repair consist is routine stuff, its expenses can be deducted instantly.

The criteria for immediately deductible repairs:

-

Activities that are regularly recurring and are expected to be done.

-

When your the repair is a result of the same use of it.

-

For a property to keep the operation as it should generally be.

-

It is expected that those repair will be needed:

Once in ten years for building.

Once in class life for non-building property.

Building repairs

Partial Dispositions

If the owner of an asset is replacing the roof on is the rental property we have a situation to think of. The value of the property is split in two, the land which is a nondepreciating asset and the structure itself. The building was capitalized and depreciated over the years. (27.5 years for residential use or 39 years for commercial use) The roof is part of the building, so it was depreciated over the years. The new roof will have its depreciation running apart from the building itself. In this case, there is the IRS partial disposition that the taxpayer should use.

The old roof value will be taken off the cost of the building, and the new roof value will be running depreciation.

Take a note:

To be able to determinate correctly what is deductible and what needs to be capitalized we need to check what are the expenses, its cost and what was repaired or improved and what was only maintenance.

Create a paystub for every payroll

Create a paystub for every payroll

Check up your repair or maintenance expense:

-

Check the invoice for the expenses.

-

What was the purpose of the expenses? BRA test can help you. Is the expense a betterment, a restoration or an adaptation?

-

How much you spent?

-

Make sure that your invoices are $2,500 or use minimis safe harbor.

-

Did you spend more or less than $10,000 or 2% of the unadjusted basis of the property being repaired? Consider using the safe harbor election for small taxpayers.

-

What type of repair you made and how to present it to the IRS, you can use a safe harbor for routine maintenance.

-

Consider using the write-off as “limited disposition.”

Capitalize the expenses you need and set up a depreciation schedule for writing off the repair expense.