Presented by Paystrubmakr.com  By John Wolf

By John Wolf

Small Employer HRA §9831(d)(2)

A Health Reimbursement Arrangement or Account (HRA) is an IRS-approved,

employer-funded, tax-advantaged employer health benefit plan that reimburses

employees for out-of-pocket medical expenses and individual health insurance

premiums. For 2018, HRA payments and reimbursements for qualifying medical

care expenses of an eligible employee cannot exceed $5,050 (up from $4,950 for

2017), or $10,250 in the case of an arrangement that also provides for payments

or reimbursements for family members of the employee (up from $10,000 for

2017).

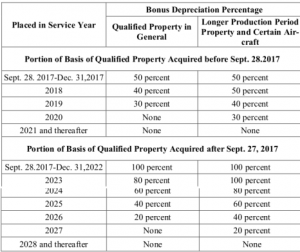

Bonus (or Additional First-year) Depreciation – §168(k)

Business taxpayers can recover the cost of capital expenditures over time according to a depreciation schedule (§168). However, at various times,

Congress has permitted such taxpayers to take an additional (or bonus) depreciation deduction allowance equal to 50% or 100% of the cost of the depreciable property.

For qualified property acquired and placed in service after September 27, 2017,

and before 2023, the bonus depreciation rate is increased to 100%. However, the

100% allowance is decreased by 20% per calendar year for property placed in service and specified plants planted or grafted in taxable years beginning after 2022 (after 2023 for more extended production period property and specific aircraft). As a result, the bonus depreciation percentage rates are as follows.

Property acquired before September 28, 2017, is subject to a 50% rate if placed

in service in 2017, a 40% rate if placed in service in 2018, and a 30% rate if

placed in service in 2019. A taxpayer may elect to apply the 50% rate instead of

the 100% rate for qualified property placed in service during the taxpayer’s first

tax year ending after September 27, 2017.

Qualified Property – §168(k)(2)

Property that qualifies for this special depreciation allowance includes:

(1) tangible property depreciated under the modified accelerated cost recovery system (MACRS) with a recovery period of 20 years or less,

(2) water utility property,

(3) off-the-shelf computer software, or

(4) qualified leasehold improvement property (despite not explicitly been named). 26 U.S. Code § 168.An accelerated cost recovery system

Useful for property acquired and placed in service after September 27,

2017, the used property would qualify for bonus depreciation if the taxpayer did not

use the feature before buying it, and the taxpayer acquired the property

by purchase.

Depreciation Limits on Business Vehicles – §168(k)(2)(F)

Because of bonus depreciation, the limitation under §280F on the amount

of depreciation deductions allowed concerning certain passenger au-

automobiles are increased in the first year by $8,000 for cars that

qualify (and for which the taxpayer did not elect out of the additional

the first-year deduction). The $8,000 increase is not indexed for inflation.

Note: For vehicles acquired before September 28, 2017, the $8,000 increase amount is phased down from $8,000 by $1,600 calendar year beginning in 2018. Thus, the §280F increase amount for 2018 is $6,400, and for 2019 is $4,800. 2019 inflation-adjusted vehicle depreciation limits and income inclusions issued

Nonqualified Property – §168(k)(2)

Property that does not qualify for special depreciation allowance includes:

(1) property placed in service and disposed of in the same tax year;

(2) property converted from business use to personal use in the same tax year it is acquired,

(3) property required to be depreciated under the alternative depreciation system (ADS); and

(4) the property included in a class of property for which you elected not to

claim the special depreciation allowance vehicles.

Vehicle Depreciation “Caps” – §280F(a)

Automobiles and other vehicles are subject to strict depreciation and expensing rules and limitations. Unlike many other assets, there are limits on the amount of annual depreciation (regular or bonus) that can be claimed.

For cars placed in service in 2017, the depreciation deduction (including the

§179 expensing deduction) could not be more than $3,160 ($11,160 if first-year

bonus depreciation was used) for the first tax year of the recovery period, $5,100

for the second year, $3,050 for the third year, and $1,875 for each later tax year same figures as in 2016. For trucks and vans placed in service in the calendar year 2017, the depreciation cap was $3,560 ($11,560 if bonus depreciation was used) in the first year, $5,700 in the second year, $3,450 in the third year, and $2,075 in the fourth year and after that (§280F(a)(2)(A)).

For 2018, the depreciation limitation under §280F for passenger vehicles has been increased. The depreciation deduction (including the §179 expensing de-

duction) could not be more than $10,000 ($18,000 if first-year bonus depreciation is used) for the first tax year of the recovery period, $16,000 for the second year, $9,600 for the third year, and $5,760 for each later tax year. These amounts are to be adjusted annually for inflation. Car Depreciation Calculator

Bonus Depreciation – Good News, Bad News

The first-year depreciation cap on a passenger vehicle is increased by $8,000

if 100% bonus depreciation is claimed. However, due to a prior law conflict,

no depreciation deductions are allowed after the first recovery year if 100%

bonus depreciation was claimed. It is anticipated that an IRS safe harbor ruling will relieve this conflict.

$25,000 Limit

The $25,000 maximum §179 deduction limit on specified vehicles that are exempt from the passenger vehicle depreciation caps is adjusted for inflation after 2018. Such vehicles include sport utility vehicles, trucks with an interior cargo bed length less than six feet, and certain weighted vans (§179(b)(5)).

Expensing – §179

A taxpayer with a sufficiently small amount of annual investment may elect to

deduct the cost of particular property placed in service for the year rather than depreciate those costs over time (§179).

Comment: Section 179 applies to both new and used property. However,

§179, with its threshold ceiling, is designed mainly for use by small businesses.

The §179 deduction is limited to taxable income derived from the active conduct of the trade or business during the tax year(179(b)(3)). However, amounts of disallowed may be carried forward and deducted.

Note The allowance of expensing for off-the-shelf computer software ap-

plied to software placed in service before 2015 (§179(d)(1)(A)(ii)).

For the year 2010 through 2014, the maximum §179 deduction for qualified §179 property placed in service was $500,000. This limit was reduced by the amount by which the cost of §179 ownership placed in service in the tax year exceeded $2 million.

The “through 2014” date reflected the retroactive reinstatement of these provisions by the Tax Increase Prevention Act of 2014 (H.R. 5771) for 2014. Thus, the §179 dollar and investment limitations were $500,000 and $2 million, respectively, for tax years, beginning in 2014.

Note: Congress also expanded the coverage of §179 to qualified real property, defined as eligible leasehold improvement property, qualified restaurant property, and qualified retail improvement property (§179(f)(1)). However, this expensing was limited to $250,000 of the total cost of such features.

In 2015, the Protecting Americans from Tax Hikes (PATH) Act of 2015 made

§179 permanent. The special rules that allow expensing for computer software and qualified real property (qualified leasehold improvement property, eligible restaurant property, and qualified retail improvement property) also were permanently extended.

Moreover, PATH modified the expensing limitation by indexing both the

$500,000 and $2 million limits for inflation beginning in 2016 and by treating air

conditioning and heating units placed in service in tax years beginning after 2015

as eligible for expensing. The act further modified the expensing limitation concerning qualified real property by eliminating the $250,000 cap beginning in

2016. Finally, PATH made permanent the treatment of off-the-shelf computer software as qualifying property.

Note: If Congress had not extended this provision and, if the increased coverage had not been reinstated, amounts would have reverted to $25,000 and $200,000 in 2015 and 2016.

For 2018, the aggregate cost of any §179 property treatable as an expense cannot exceed $1,000,000. This limitation is reduced (but not below zero) by the cost of §179 property placed in service during 2018, exceeding $2,500,000. The

$1,000,000 and $2,500,000 amounts (as well as the $25,000 sports utility vehicle

limitation) are indexed for inflation for taxable years beginning after 2018. In

addition, the definition of §179 property is expanded to include certain depreciable tangible personal property used predominantly to furnish lodging. The definition of qualified real property eligible for §179 expensing is expanded to include any of the following improvements to nonresidential real property placed in service: roofs, heating, ventilation, and air-conditioning property; fire protection and alarm systems; and security systems.

§179 property placed in service during 2018, exceeding $2,500,000. The

$1,000,000 and $2,500,000 amounts (as well as the $25,000 sports utility vehicle

limitation) are indexed for inflation for taxable years beginning after 2018. In

addition, the definition of §179 property is expanded to include certain depreciable tangible personal property used predominantly to furnish lodging. The definition of qualified real property eligible for §179 expensing is expanded to include any of the following improvements to nonresidential real property placed in service: roofs, heating, ventilation, and air-conditioning property; fire protection and alarm systems; and security systems.

General Business Credit – §38

No general business credit under §38 is allowed with respect to any amount for which a deduction is allowed under §179 (§179(d)(9)). If a corporation makes an election under §179 to deduct expenditures, the full amount of the deduction does not reduce earnings and profits. Rather, the spending that is deducted reduces corporate earnings and profits ratably over a five – year period (§312(k)(3)(B)).

Special Film & T.V. Production Expensing (Expired) – §181

Under §181, taxpayers could elect (see Treas. Reg. §1.181-2T) to deduct the cost

of any qualifying film and television production in the year the expenditure was

incurred in lieu of capitalizing the cost and recovering it through depreciation allowances. This provision allowed film and television producers to expense the first $15 million of production costs incurred in the United States ($20 million if

the costs are incurred in economically depressed areas in the United States).

A qualified film or television production was any production of a motion picture

(whether released theatrically or directly to video cassette or any other format)

or television program if at least 75% of the total compensation expended on the

production was for services performed in the United States by actors, directors,

producers, and other relevant production personnel.

The term “compensation” did not include participations and residuals (as de-

fined in §167(g)(7)(B)). Each episode of a television series was treated as a separate production, and only the first 44 episodes of a particular series qualify under the provision. Qualified productions did not include sexually explicit productions.

Note: For recapture under §1245, any deduction allowed under §181 was

treated as if it were a deduction allowable for amortization.

This provision was scheduled to expire for taxable years after December 31,

2014. However, the PATH Act extended the special treatment for film and television productions under §181 to qualified film and television productions commencing prior to January 1, 2017. However, as of this writing, Congress has not extended this provision.

General Business Credit – §38

No general business credit under §38 is allowed with respect to any amount for which a deduction is allowed under §179 (§179(d)(9)). If a corporation makes an election under §179 to deduct expenditures, the full amount of the deduction does not reduce earnings and profits. Rather, the expenditures that are deducted reduce corporate earnings and profits ratably over a five-

year period (§312(k)(3)(B)).

Special Film & T.V. Production Expensing (Expired) – §181

Under §181, taxpayers could elect (see Treas. Reg. §1.181-2T) to deduct the cost

of any qualifying film and television production in the year the expenditure was

incurred in lieu of capitalizing the cost and recovering it through depreciation allowances. This provision allowed film and television producers to expense the

first, $15 million of production costs incurred in the United States ($20 million if

the costs are incurred in economically depressed areas in the United States).

A qualified film or television production was any production of a motion picture

(whether released theatrically or directly to video cassette or any other format)

or television program if at least 75% of the total compensation expended on the production was for services performed in the United States by actors, directors, producers, and other relevant production personnel. THE SECTION 181 FILM TAX DEDUCTION IS BACK

The term “compensation” did not include participations and residuals (as de-

fined in §167(g)(7)(B)). Each episode of a television series was treated as a separate production, and only the first 44 episodes of a particular series qualify under the provision. Qualified productions did not include sexually explicit productions.

Note: For recapture under §1245, any deduction allowed under §181 was

treated as if it were a deduction allowable for amortization.

This provision was scheduled to expire for taxable years after December 31,

2014. However, the PATH Act extended the special treatment for film and television productions under §181 to qualified film and television productions commencing before January 1, 2017. However, as of this writing, Congress has not extended this provision.

Live Theatrical Productions

PATH also expanded §181 to include any qualified live theatrical production

commencing after December 31, 2015. A qualified live theatrical production

is a live staged production of a play (with or without music) which is derived

from a written book or script and is produced or presented by a commercial

an entity in any venue which has an audience capacity of not more than 3,000, or

a series of venues the majority of which has an audience capacity of not

more than 3,000. It also includes any live staged production produced or presented by a taxable entity no more than ten weeks annually in any venue, which has an audience capacity of not more than 6,500.

Estimated Tax Payments – §6654

To the extent that tax is not collected through withholding, taxpayers are re-

quired to make estimated quarterly payments of tax, the amount of which is determined by reference to the required annual salary.

For 2018, the required annual payment is the lesser of:

(1) 90% of the tax shown on the return, or

(2) 100% of the tax shown on the return for the prior taxable year (110% if

the adjusted gross income for the preceding year exceeds $150,000).

For calendar-year taxpayers, the installments are due on April 15, June 15, September 15 and January 15.

Standard Mileage Rates

The standard mileage deduction allows a “flat” or standard amount of deduction

for every business mile traveled regardless of the actual cost, and therefore only re-

quires substantiation of the distance traveled in the pursuit of trade or business.

Business mileage: For 2017, the standard mileage rate for the cost of operating your car van, pick-up, or panel truck for business use was 53.5 cents per

mile.

For 2018

The standard mileage rate for the cost of operating your car van,

pick-up or panel truck for business use is 54.5 cents per mile.

Medical and move-related mileage: For 2017, the standard mileage rate for

the cost of operating your car for medical reasons or as part of a deductible

the move was 17 cents per mile.

For 2018, the standard mileage rate for the cost of operating your car for

medical reasons or as part of a deductible move is 18 cents per mile.

Charitable-related mileage: For 2017 and 2018, the standard mileage rate for

the cost of operating your car for charitable purposes remains 14 cents per

mile (Notice 2018-03).

Note: A taxpayer may not use the business standard mileage rate for a vehicle after using any depreciation method under the Modified Accelerated

Cost Recovery System (MACRS) or after claiming a §179 deduction for that vehicle. In addition, the business standard mileage rate cannot be used for more than four vehicles used simultaneously (R.P. 2010-51).

Comment: Taxpayers always have the option of calculating the actual costs

of using their vehicle rather than using the standard mileage rates.

paystumbmakr.com team thanks you for a visit and reading this blog Pays tub online About pay stubs

Learn how to create your pay stub

paystubmakr.com

Disclaimer: John Wolf and paystubmakr.com are making a total effort to offer accurate, competent, ethical HR management, employer, and workplace advice. We do not use the words of an attorney, and the content on the site is not given as legal advice. The website has readers from all US states, which all have different laws on these topics. The reader should look for legal advice before taking any action. The information presented on this website is offered as a general guide only.