PAYSTUB MAKER give you more to read more about S Corporation

Sales or Exchanges of Stock or Securities

A sale or exchange of stock or securities is included in gross receipts only to the extent of the gain. Losses on sales or exchanges are not a part of gross receipts. Nor are they offset against gains on sales or exchanges when figuring gross receipts. This applies even if the S corporation is a regular dealer in stocks and securities. However, amounts received in exchange for stock in a corporate liquidation are not included in gross receipts if the S corporation owned more than 50% of each class of the liquidating corporation’s stock on the date of the first distribution concerning the liquidation. This 50% requirement applies to a class of stock whether or not the class of stock has voting rights. For this requirement, shares of stock of the liquidating corporation held by an S corporation shareholder are not treated as held by the S corporation.

Questions and Answers on the Net Investment Income Tax

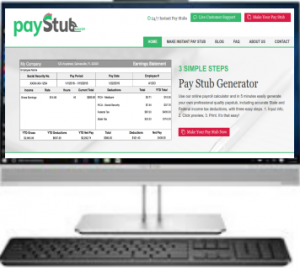

Paystub Generator at your service

Paystub Generator at your service

Passive Investment Income

Passive investment income includes gross receipts from royalties, rents, dividends, interest, annuities, and sales or exchanges of stock or securities. The amount included in passive investment income for sales or exchanges of stock or securities for an S corporation that is not an “options dealer” or “commodities dealer” is specially figured as explained above. If the S corporation is an “options dealer” or a “commodities dealer,” any gains or losses from section 1256 contracts (regulated futures contracts, foreign currency contracts, nonequity options, and dealer equity options) or property related to such contracts are not included when the computations are made.

Old time printing of a pay stub

Royalties

Royalties include mineral, oil, and gas royalties, and amounts the S corporation receives for using patents, copyrights, secret processes, formulas, goodwill, trademarks, trade brands, franchises, and other property. Rents are amounts the S corporation receives for the use of, or the right to use, its real or personal property. If you provide significant services to the occupant, rental payments do not cover the use or occupancy of the property.

Payments not treated as rents

Examples of payments not treated as rents include payments for the use or occupancy of rooms or other quarters in hotels, boarding houses, apartment houses that provide hotel services, tourist homes, motor courts, or motels. Convenient services not provided in rental spaces are essential for occupants. For example, providing maid service is considered significant to the occupant. Heat and light, cleaning public entrances, exits, stairways, and lobbies, collecting trash, etc., are optional services. Paying for parking or using personal property with significant services provided is not considered rent.

Paystub Template and Generator

Paystub Template and Generator

Interest

Interest is an amount received for the use of money, including tax-exempt interest and unstated interest. Unstated interest includes amounts considered interest on notes or obligations received in installment sales, obligations issued for property, and below-market loans when the contract does not contain a stated rate of interest, or the stated rate is below the appropriate federal rate. However, interest on obligations acquired in the ordinary course of the S corporation’s trade or business from the performance of services or the sale of inventory or property held primarily for sale to customers is excluded from passive investment income.

Printing machinery of 100 years ago

Pre-calculating the Tax on Excess Net Passive Income

An S corporation is liable for a tax at a rate of 35%, on excess net passive income if its passive investment income is more than 25% of gross receipts. And if at the end of the tax year it has earnings and profits from any tax year in which the corporation was not an S corporation. Net Passive Income Net passive income is passive investment income, described above, and reduced by deductions directly connected with the production of passive investment income. This does not include net operating losses and dividends-received deductions allowed to corporations that are not S corporations. Investment-related deductions allowable in figuring net passive income include brokerage fees, interest expenses, safe deposit box rentals, and investment advisory fees.

Determining the Taxability of S Corporation Distributions: Part I

Excess Net Passive Income

Excess net passive income for the tax year is the amount that has the same ratio to net passive income as the amount of passive investment income that exceeds 25% of gross receipts has to total passive investment income. Therefore, to figure excess net passive income, multiple net passive incomes by a fraction consisting of passive investment income minus 25% of gross receipts over passive investment income.

Example

An S corporation (with subchapter C earnings and profits) has gross receipts of $10,000. Of this amount, $4,000 is passive investment income. After subtracting applicable deductions, net passive investment income is $3,000. Excess passive investment income equals $1,125 ($3,000 x $1,500/$4,000). The corporation must pay corporate income tax on $1,125. If the situation continues for three years, the S-election is revoked.Determining the Taxability of S Corporation Distributions: Part I

Determining the Taxability of S Corporation Distributions: Part II

Excess net passive income cannot be more than the S corporation’s taxable income for the year.

All that you need for printing of your payroll and paystubs

Special Provisions

The only credit the S corporation can use to offset this tax is the credit figured on Form 4136, Credit for Federal Tax on Fuels. When calculating the tax on excess net passive income and the tax on capital gains, using revenue can lower the amount of gain subject to the capital gains tax. The total passive investment income for figuring the tax on excess passive income is determined by not considering any recognized built-in gain or loss of the corporation. If the S corporation is subject to the tax on extra net passive income, it must reduce the items of passive income passed through to the shareholders.

Paystub Maker team thanks you for reading its Blog. Next Blog will tell you more about S Corporation.

Paystub maker is your place for the best template

Paystub maker is your place for the best template

Pay stub Maker team thanks you for reading its Blog

Next Blog will tell you more about S Corporation.