A word on paystub and payroll: In today’s business world, most larger companies have included pay stubs into their payroll activities, but many smaller organizations, particularly individual entrepreneurs that are new as employers may be slow to make the transition.

PAYSTUB MAKER give you more to read more about S Corporation

Decreases

Each stockholder pro rata share of the following items decreases the basis of the stock:

(1) Distributions by the S corporation that were not included in the shareholder’s income,

(2) All loss and deduction items of the S corporation that are separately stated and passed through to the shareholder,

(3) Any separately stated loss of the S corporation,

(4) Any expense of the S corporation that is not deductible in figuring its income and not properly chargeable to capital account, and

(5) The stockholder’s deduction for depletion of oil and gas property held by the S corporation to the extent it is not more than the shareholder’s share of the adjusted basis of the property.

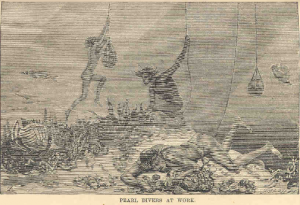

For pearl divers payroll is made by pearls and no paystubs are made.

Paystub Generator, the best software at your service

Paystub Generator, the best software at your service

Adjustments to Debt Basis

In certain cases, a shareholder may decrease the basis of any loans he or she made to the S corporation, and in later years restore the basis. If for any tax year the amounts specified in items (2), (3), (4), and (5), above, under Decreases, exceed the amount required to reduce the shareholder’s basis in stock to zero, the excess must be used to reduce, but not below zero, the shareholder’s basis in any loans made to the S corporation.

LB&I Concept Unit Knowledge Base for S Corporations

Restoring Basis of Loans

If the shareholder’s basis in any loans made to the S corporation is reduced, as previously explained, any net increase for a later tax year, figured above under Adjustments to basis of shareholder’s stock, should first be used to restore the basis of the loans and next to increase the basis of the stock.

Diving photographer.

Structuring loans for S corp. shareholder basis planning opportunities

Loan Repayments

If the shareholder’s basis in the loan was reduced (and has not subsequently been completely restored), he or she will have income (other than interest) when the S corporation makes a payment on the loan. Each loan payment (other than interest) must be allocated in part to a return of the shareholder’s basis in the loan and part of their income. To figure the amount of income to report on the loan payments, the shareholder should:

1. Figure the adjusted basis of the loan before payment.

2. Divide the adjusted basis in the loan by the outstanding loan balance.

3. Multiply the payment by the percentage from step 2. This amount is the part of the payment that will be a return of basis in the loan.

4. Take the difference between the amount of the payment and the amount from step 3. This is the amount that the shareholder must report as ordinary income.

S Corporation Employees, Shareholders, and Corporate Officers

The basis of the loan is reduced even if the shareholder has no tax benefit from the deduction for the basis reduction. To figure the adjusted basis of the loan for later payment, for lat-

Er restoration of basis, or for a later reduction of basis in the loan because of additional losses, the shareholder should subtract any amounts that are a return of basis from the adjusted basis of the loan.

Old time diving suit.

Guarantees

A shareholder often guarantees payment of corporate loans. When the corporation has losses that exhaust the basis of the shareholder’s stock and direct loans to the corporation, the shareholder may assert that the guaranteed loan gives them additional basis against which corporate loss.

Es can be offset. However, the courts hold that the guarantee does not furnish the shareholder with any basis unless and until the shareholder makes payment on the guaranty (at which time that payment will be treated as a direct loan to the corporation) (Estate of Leavitt v. Commissioner, 875 F. 2d 422 (4th Cir. 1989)). At-Risk Rules – §465 At-risk rules may limit an S corporation shareholder’s deductible loss from an activity conducted by an S corporation. These limitations

apply at the shareholder level.

An S corporation shareholder’s amount at risk equals:

Paystub maker is your place for the best template

Paystub maker is your place for the best template

(1) The shareholder’s cash contributions and the adjusted basis of other property that the shareholder contributed to the S corporation, plus

(2) Funds borrowed for use in the activity that the shareholder is liable for the repayment of, or has guarantee property not used in the activity as security for the borrowed amount. To determine if the at-risk rules apply to an activity, the S corporation must identify each activity engaged in. Therefore, when the S corporation is involved in more than one activity, and one or more of the activities incur a loss for the year, the profit and loss of each activity are figured separately. The S corporation should provide each shareholder with a schedule that reflects that shareholder’s part of gross income and deductions for each activity. Separate activities must be combined and treated as one activity if:

(1) The shareholder actively participates in the management of the trade or business, or

(2) 65% or more of the losses from the operations are allocated to persons who actively participate in the management of the commerce or business. Also, all activities involving tangible personal property leased or held for lease must be treated as one activity. The at-risk rules do not apply to an activity of holding real property (other than mineral property) if the property was placed in service before 1987, and the shareholder acquired the interest in the S corporation before 1987. However, the at-risk rules do apply to losses from an interest in an S corporation acquired after 1986, regardless of when the property used in the activity of holding real property was placed in service. Quotes from Instructions for Form 6198 IRS

A diving worker is giving maintenance underwater.

Paystub Maker team will write about S Corporation.

Thanks for visiting our website