Presented by Paystrubmakr.com  By John Wolf and Tom Cullen CPA

By John Wolf and Tom Cullen CPA

PAYS TUB MAKER informing about retirement

Definitions IRA Account Balance

The IRA account balance is the amount in the IRA at the end of the year preceding the year for which the required minimum distribution is being figured. The IRA account balance can adjust itself by certain contributions, distributions, outstanding rollovers, and re-characterizations of Roth IRA conversions.

Planning to Retire in 2021: A Complete Guide

Designated Beneficiary

The term “designated beneficiary” is a term of art, and means that the beneficiary must be a human being. Thus, an estate is not a “designated beneficiary” nor is a charity or other legal entity. If there is more than one beneficiary, then all of them must be human beings, or there is no designated beneficiary. Note: There is an exception to this rule if each beneficiary has his or her or their certain separate account. If the beneficiary is a trust, and all of the beneficiaries of the trust are human beings, they will be treated as designated beneficiaries, if certain conditions are met.

Here you make your low-cost Paystubs.

Here you make your low-cost Paystubs.

Date of The Designated Beneficiary Is Determined

The designated beneficiary is determined on the last day of the calendar year following the calendar year of the IRA owner’s death. Any person who was a beneficiary on the date of the owner’s death, but is not a beneficiary on the last day of the calendar year following the calendar year of the owner’s death (because, for example, he or she disclaimed entitlement or received his or her entire benefit), will not be taken into account in determining the designated beneficiary.

Five IRA Deadlines Every Smart Investor (Or Advisor) Should Know by FORBES

Distributions during Owner’s Lifetime & Year of Death after RBD

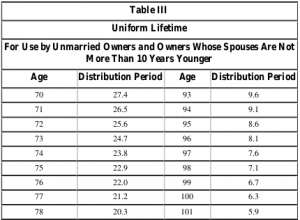

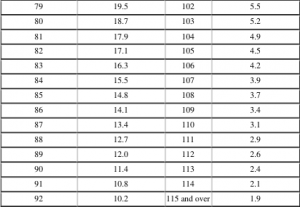

Required minimum distributions during the owner’s lifetime (and in the year of death if the owner dies after the beginning date) are based on a distribution period that is determined using Table III from IRS Publication 590 and set forth below. The distribution period (i.e., which table is used) is not affected by the beneficiary’s age unless the sole beneficiary is a spouse who is more than ten years younger than the owner.

To figure the required minimum distribution for the current year, divide the account balance at the end of the preceding year by the distribution period from the table. This is the distribution period listed next to the owner’s age (as of the current year) in Table III below. Unless the sole beneficiary is the owner’s spouse who is more than ten years younger.

Publication 590-B (2017), Distributions from Individual Retirement Arrangements (IRAs)

Sole Beneficiary Spouse Who Is More Than 10 Years Younger

If the sole beneficiary is the owner’s spouse and their spouse is more than ten years younger than the owner, use the life expectancy from Table II (Joint Life and Last Survivor Expectancy) in IRS Publication 590. The life expectancy to use is the joint life and last survivor expectancy listed where the row or column containing the owner’s age as of their birthday in the current year intersects with the row or column containing their spouse’s age as of their birthday in the current year. To figure the required minimum distribution for the current year, divide the account balance at the end of the preceding year by the life expectancy.

Topic Number 510 – Business Use of Car by IRS

Distributions after Owner’s Death

A beneficiary as an Individual

If the designated beneficiary is an individual, such as the owner’s spouse or child, required minimum distributions for years after the year of the owner’s death are based on the beneficiary’s single life expectancy.

Paystub Generator at your service

Paystub Generator at your service

Note: This rule applies whether the death occurred before the owner’s required beginning date. To figure out the required minimum distribution for the current year, divide the account balance at the end of the preceding year by the appropriate life expectancy from Table I (Single Life Expectancy) (For Use by Beneficiaries) in IRS Publication 590. Determine the proper life expectancy as follows.

• Spouse as the sole designated beneficiary. Use the life expectancy in the table next to the spouse’s age (as of the spouse’s birthday in the current year). If the owner died a year after they reached age 701⁄2, distributions to the spouse do not need to begin until the year the owner would have reached the age 701⁄2.

• Surviving spouse. Suppose the designated beneficiary is the owner’s surviving spouse, and they die before they are required to receive distributions. In that case, the surviving spouse will have a status as if they were the owner of the IRA.

Note: The Pension Protection Act of 2006 extended the special treatment granted to spousal and non-spouse beneficiaries.

• Other designated beneficiaries. Use the life expectancy listed • Other designated beneficiaries. Use the life expectancy listed in the table next to the beneficiary’s age as of their birthday in the year following the year of the owner’s death, reduced by one for each year since the year following the owner’s death.

Here you make your low-cost Paystubs.

Here you make your low-cost Paystubs.

Individual Beneficiary

A beneficiary who is an individual may be able to elect to take the entire account by the end of the fifth year following the year of the owner’s death. If you choose to make this election, there will be no need for distribution in any year before the fifth year.

• Other designated beneficiaries. Use the life expectancy listed in the table next to the beneficiary’s age as of their birthday in the year following the year of the owner’s death, reduced by one for each year since the year following the owner’s death.

A beneficiary who is an individual may be able to elect to take the entire account by the end of the fifth year following the year of the owner’s death. If you choose to make this election, you won’t have to distribute anything for any year before the fifth year.

Topic Number 511 – Business Travel Expenses IRS

paystumbmakr.com team thanks you for a visit and reading this blog Pays tub online About pay stubs

Learn how to create your pay stub

paystubmakr.com